Last month Capital 10x launched the Golden Compass Series looking at emerging gold regions with big potential. Côte d’Ivoire was the focus, due to a rapidly improving political and business environment, untapped exploration potential and a movement of capital into the country.

One local explorer we briefly highlighted was Kobo Resources Inc. (Ticker: TSXV:KRI). In this note we dig deeper into what makes Kobo tick and why it should be in the comp sheet of any serious gold investor.

Success in the gold mining business is always determined by grade and access to infrastructure once all other variables are stripped away. Kobo is in an enviable position on both metrics.

This note will cover the geography, the rocks, the company and why West Africa, and Côte d’Ivoire, in particular, is in the early innings of capturing a flood of new global mining investment.

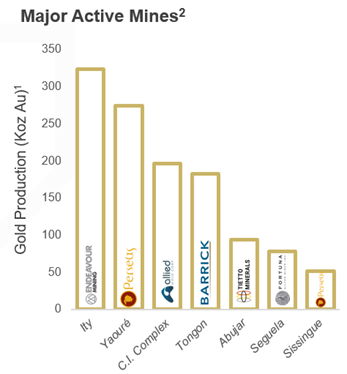

The Geography and Operating Stats

Kobo operates in central Côte d’Ivoire, only a few kilometers from Perseus Mining’s Yaouré Gold Mine (274koz – 2023), the second largest operating gold mine in the country.

To the north is Barrick with its Tongon gold mine (183koz – 2023), Endeavour Mining to the west with its Ity gold mine (324koz – 2023) and Allied Gold has two operating mines just south of Kobo’s location. A number of major and mid-tier companies looking for ounces are already present, offering Kobo a potential acquisition partner once the team proves out enough of their resource.

Cote d’Ivoire Operator Mines and Discoveries Map

In recent years, numerous billion-dollar buyouts involving gold mines have taken place in Côte d’Ivoire, including Endeavour Minnig’s acquisition of SEMAFO for C$1 billion and Teranga Gold for C$2.4 billion, and Fortuna Silver’s acquisition of Roxgold for C$1 billion.

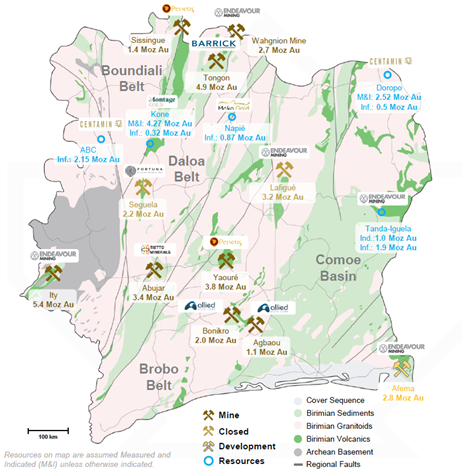

Proximity is Key

The proximity of Kobo to the Yaouré Gold Mine means that it has the potential to access most of the important infrastructure necessary to operate a gold mine. Also, Kobo’s recent exploration and structural geology work has interpreted its Kossou Gold Project to have similar gold mineralization and structures as to what is found at the adjacent Yaouré gold deposit.

Kobo Research Permit Map

In the short term, Kobo’s main objective is the exploration and development of the Kossou Gold Project, which covers 146 square kilometers. Its Kossou Gold Project is located 22 kilometers to the northwest of the capital city of Yamoussoukro and 250 kilometers from the financial capital of Abidjan and is accessible primarily on paved roads or good secondary roads.

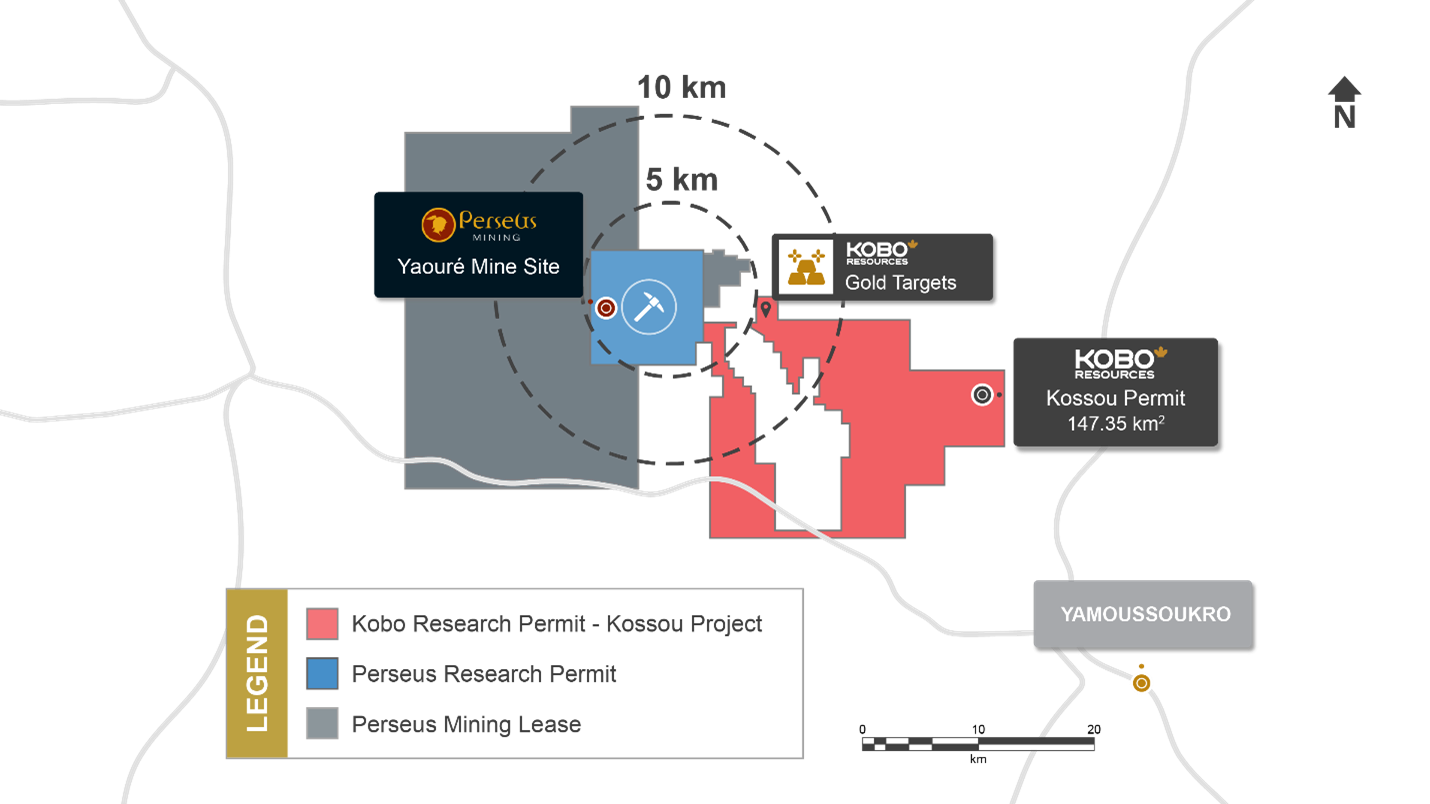

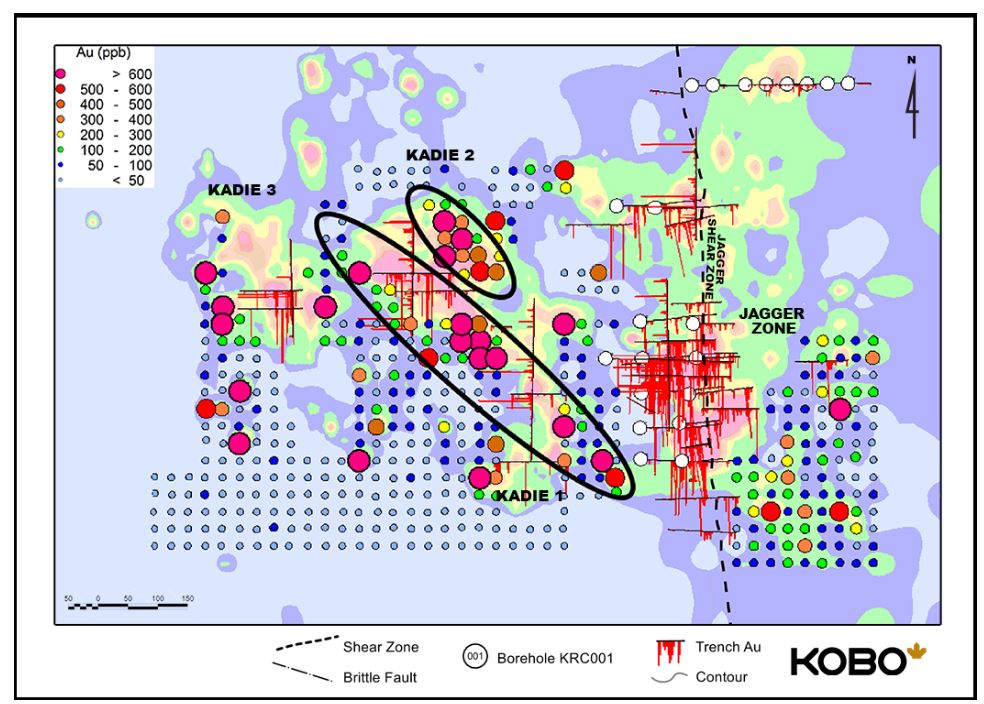

In 2023 Kobo completed 5,988 meters of drilling in 53 drill holes and dug 80 trenches over another 4,500 meters. There is ample room for additional discovery as this activity was focused on just on just northern portion of the Kossou permit.

Kobo is starting another 5,000-meter program in early March and believes they have at least 23,000 meters of additional high-potential targets to test overall on its Kossou permit.

Kobo Near Term Target Map (Gold in Soil Samples)

The Beauty of Emerging Markets: Untapped Potential

Explorers brave political turmoil and shifting operating environments in emerging markets for one reason: the gold grades and size of deposits are just that favourable.

Underexplored regions like portions of West Africa offer high grades at shallow depths, something very hard to find in developed markets with centuries of production.

Take Kobo’s Kossou Gold Project as an example. To a western mining investor, digging trenches may sound like an unsophisticated way to explore, but in reality, it means the resource is simply that abundant and close to the surface.

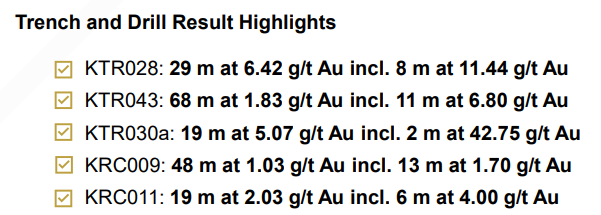

Kobo’s Jagger Zone for example, is returning up to 6.4 g/t Au over 29 meters, at surface.

In contrast there are many North American companies drilling 300-400 meters underground to find similar grades.

Jagger Zone Trench and Drill Result Highlights

Kobo has only explored 15% of the entire Kossou permit and recently identified very high gold soil geochemistry anomalies at the newly discovered Kadie Zone, which will soon be explored as part of the company’s upcoming drill program.

Management has had significant exploration success at its Kossou Gold Project targeting gold in soil anomalies.

Soil Sample Locations for Kadie Zone

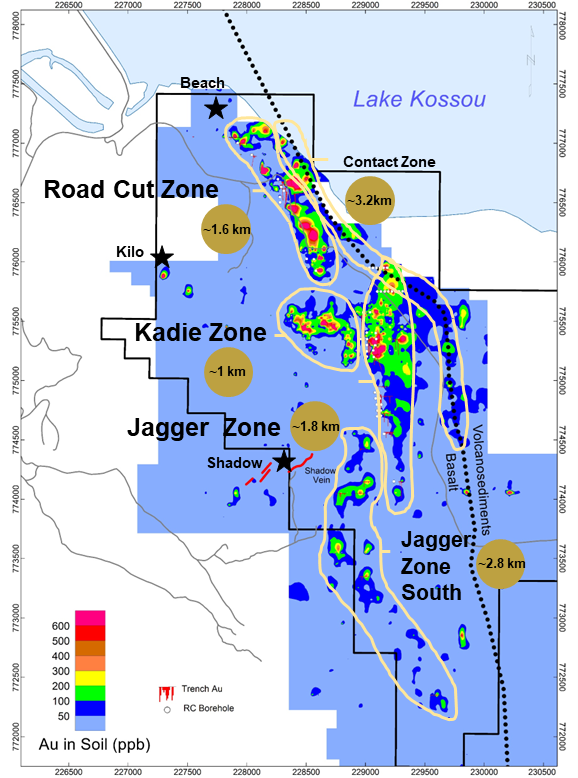

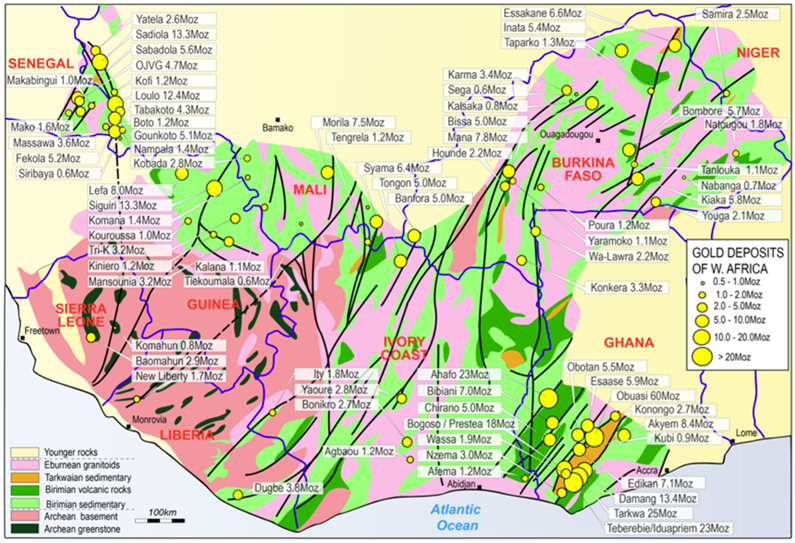

Birimian Rock Group Potential

In West Africa, Birimian Group Rocks historically have hosted most of the major gold discoveries and mines and are the key target rocks for any serious explorer in the region. It is this geological environment that Kobo is focusing its exploration efforts with great success to this point.

Birimian Group Rock Formations Across West Africa

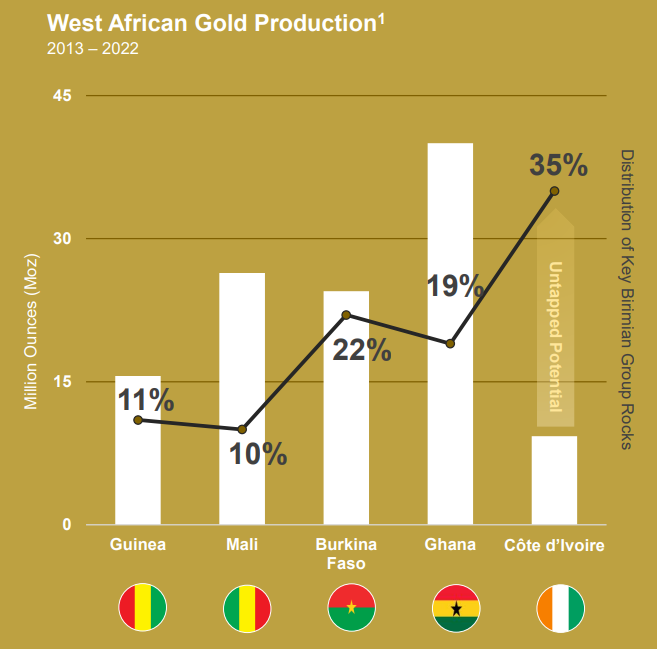

The true exploration potential of Côte d’Ivoire comes into focus when looking at its endowment of Birimian Group Rocks compared to low historical gold production.

Even though 35% of Birimian Group Rocks can be found in Côte d’Ivoire, the country represents only 7% of the gold produced in West Africa over the past decade.

The exploration upside from Cote d’Ivoire is significant.

Birimian Rocks by Country vs Historical Production

Why West Africa and Why Now?

The probability we’ve seen interest rates peak across most of the world is high. Interest rates can be a huge headwind or tailwind to the price of gold, given gold’s holding costs and lack of cashflow.

Interest rates are no longer a headwind and have the potential to become a powerful tailwind for gold prices going forward.

Market Pricing in 96% Chance of an Interest Rate Cut by July

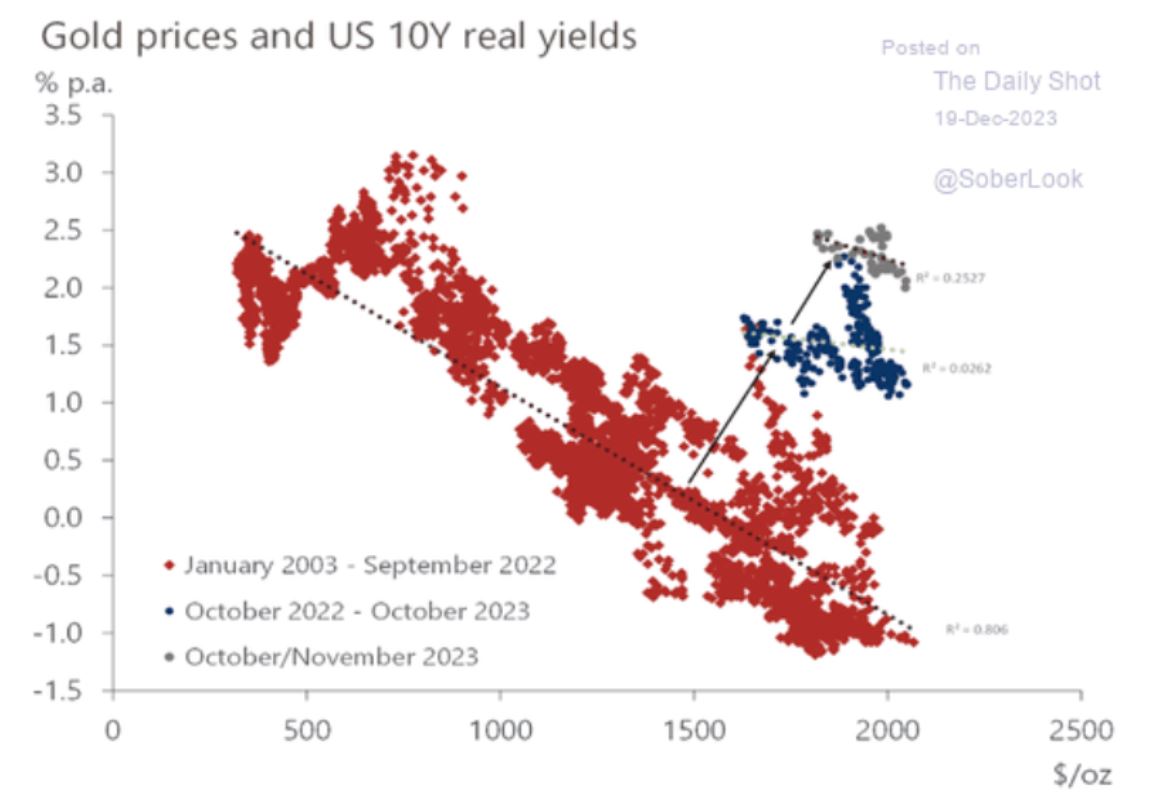

Gold is non-interest bearing money, so it’s expected that the wiggles in price will trade with shifts in interest rates. While that relationship has partially held in recent years, it’s notable that there has been a flattening and level shift, in part driven by central bank buying.

What this tells us is that even at $2,000/oz, gold prices are likely closer to a bottom than a top.

Grey is Recent Data (Breaking the Trend?)

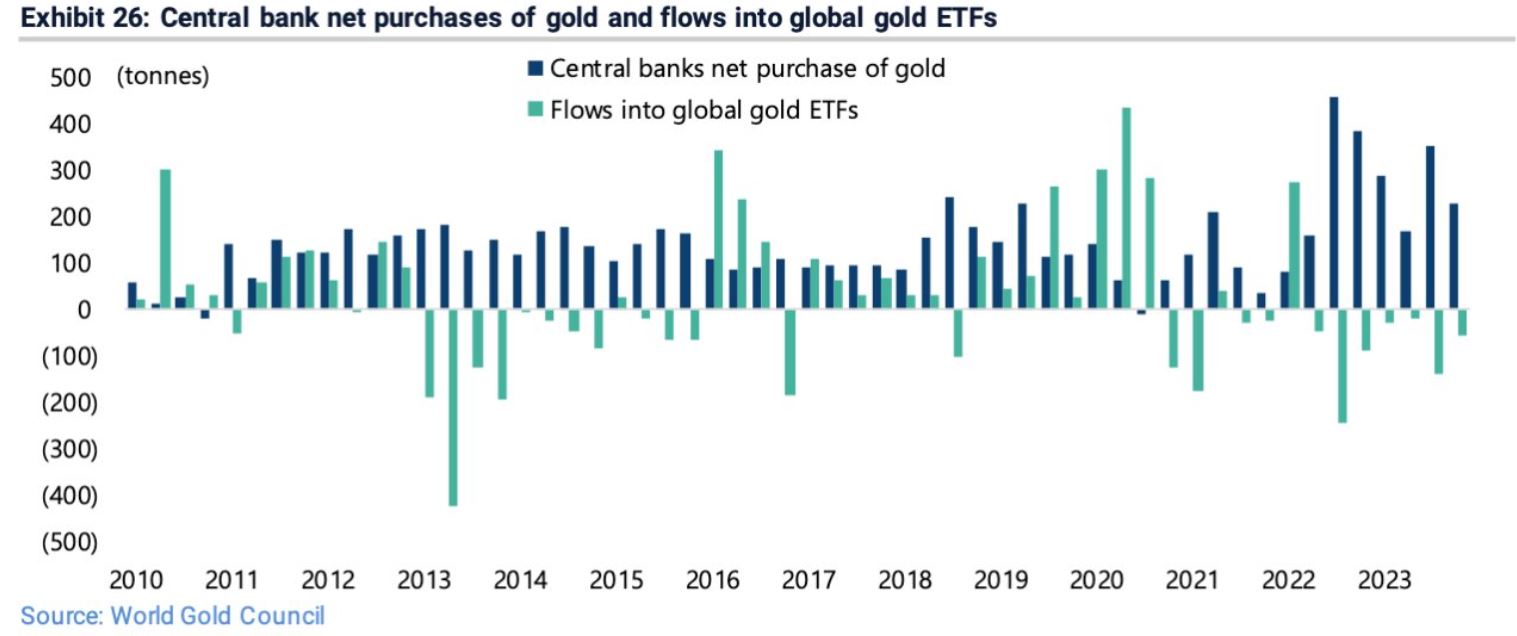

Financial buyers, mainly exchange traded funds, have been selling gold indiscriminately for the past two years. When they flip back to buyers, which happens when interest rates are on the decline, the move higher in gold could be significant

Central Banks Buying Gold While ETFs are Selling

When gold prices are on the rise, the explorers outperform the producers. Owning high potential explorers with a mix of high-grade rocks, stable and improving jurisdictions, infrastructure and potential acquirers nearby is the winning formula in our view.

Kobo Resources checks all those boxes and is worth a serious look for gold investors as they position for the coming bull market.

Kobo Resources is a market awareness client of Capital 10X. For more information, including potential conflicts of interest please see our Content Disclaimer.