A High-Growth Royalty Company in Transition

Royalties Are The Superior Way to Invest in Mining Companies

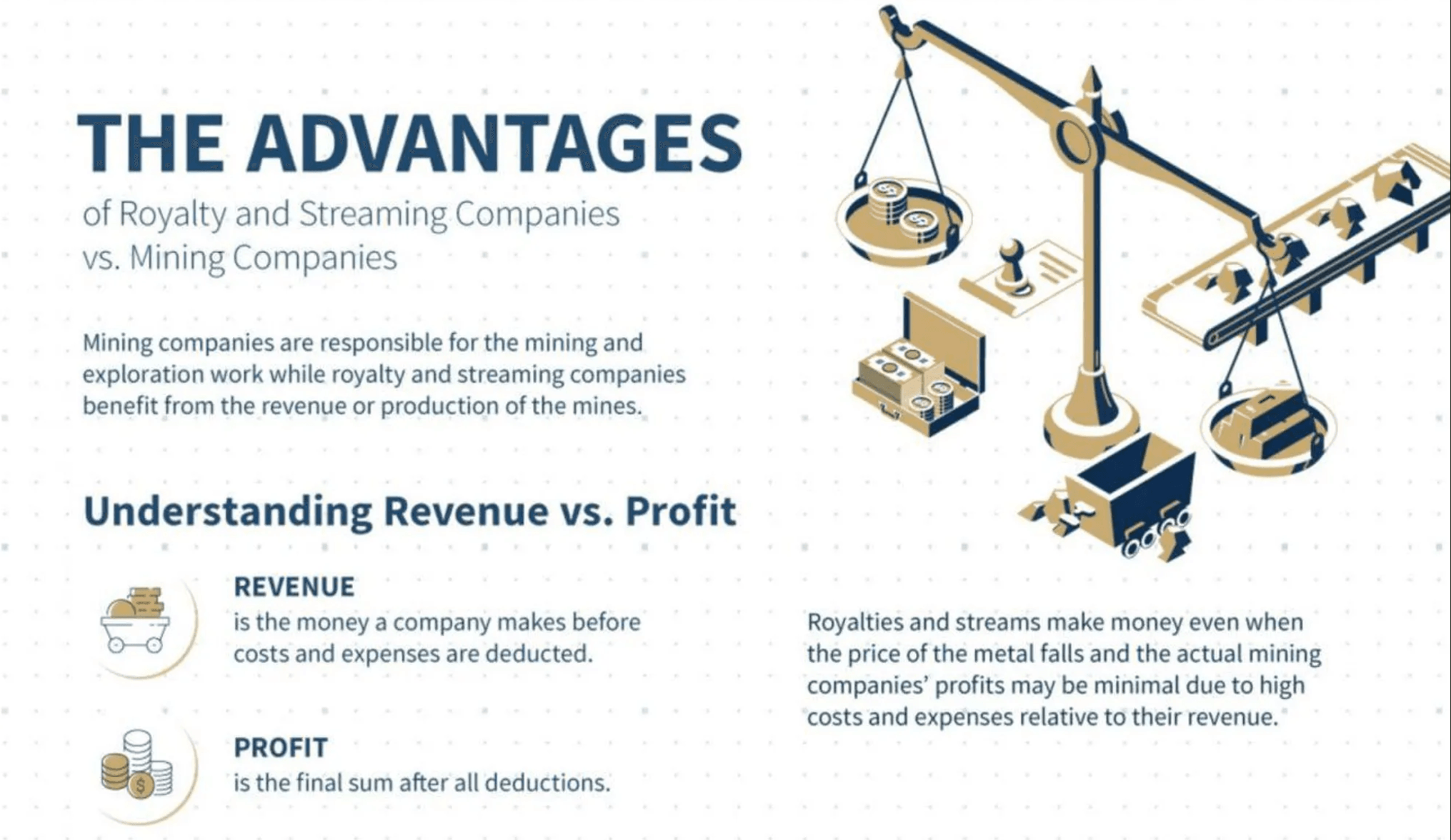

A royalty is an interest in the ultimate production of a mine. Royalties differ from owning an entire mining company in that the royalty owner usually gets paid directly from selling the output of the mine, before any operating costs are factored in. This is a huge advantage for the royalty owner.

The one advantage to owning a mining stock over a royalty is the mining stock owns the economics of 100% of the property while a royalty is sometimes on only a portion of the property.

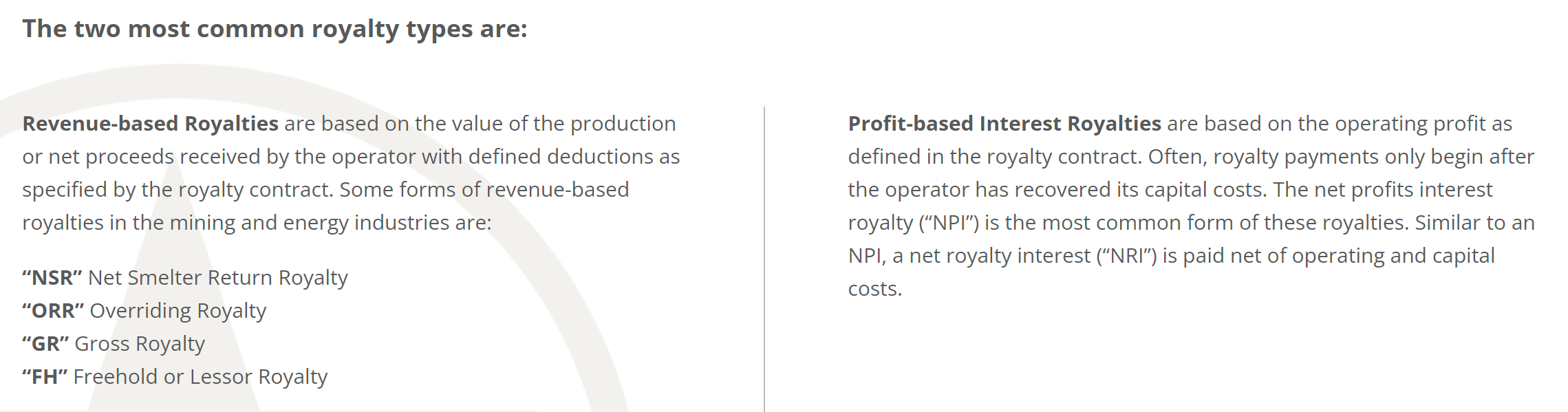

Royalties are usually revenue based and use terms like NSR (Net Smelter Royalty) or GRR (Gross Revenue Royalty). The visual below explains the most popular types of royalties and how they work.

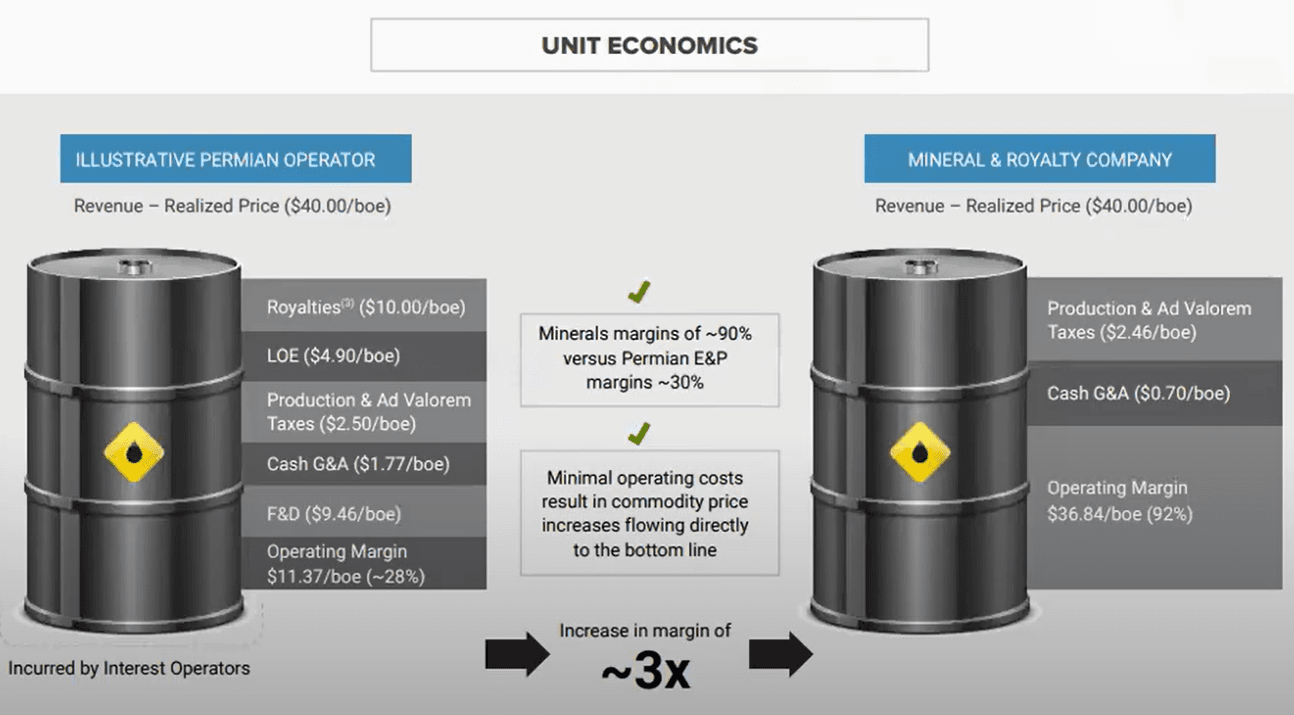

The visual below is a helpful guide to understanding the economic of different royalties. The main difference you should notice is that a royalty has essentially zero production costs. Every $1 of revenue reaches the royalty investor as profit, less taxes. The only costs you have to worry about is the corporate overhead from paying the salaries of the management team picking the royalties.

Keep in mind the royalty owner only receives a small portion of the total production of the mine, but as this illustration shows, they keep a far higher share of the revenue generated from every unit sold.

Royalties Have Three Key Advantages Over a Pure Mining Stock

Diversification

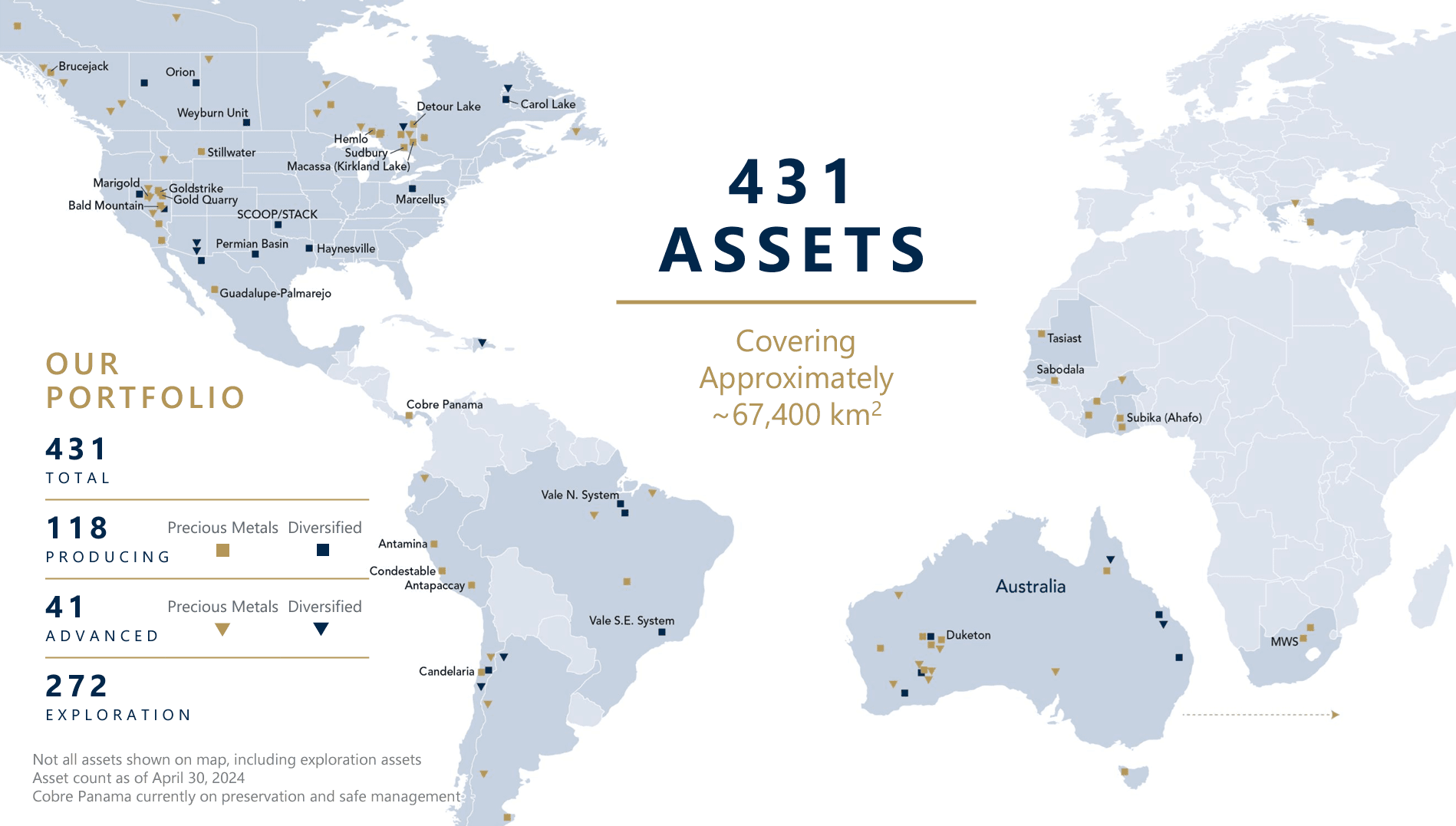

This is the huge differentiator and the main reason we believe every investor who invests in the mining space should consider owning royalties as well. Yes we’ve all heard of the mining stock that went up 10 times or more, but what you rarely hear about are the mining stocks that went to zero, and there are a lot of them. Mining is a risky business, but at a royalty company you own pieces of many different projects picked by a team with significant experience evaluating opportunities.

Diversification of Royalty Owner Franco Nevada

Royalty companies buy small royalties in many different mines giving investors key diversification by geography, commodity, mine or all three. If one project dies on the vine, it doesn’t mean an automatic writeoff for your investment.

Mining is by nature a very risky business due to exploration and commodity price uncertainty and diversification is key to staying in the game long enough to find a world class project or discovery.

No Exposure to Cost Inflation

Another significant advantage of owning a royalty is that you aren’t exposed to rising operating costs. Any investor whose been through more than one commodity cycle knows that operating costs are almost always rising, especially when commodity prices are rising as well.

So while the margins on a project end up being squeezed in a bull market, royalty investors are paid out from revenue, capturing 100% of the upside from higher prices. As long as the company’s margins are high enough to justify keeping the mine in business, royalty investors don’t have to care about operating cost inflation. This is a huge advantage to owning a royalty.

Lower Cost of Capital

The diversification benefits of a royalty company feed over into its cost of funding as well. With less risk that one problem project will sink the company, lenders are willing to offer debt at lower rates.

Debt costs today range between 5%-8.5% depending on the size and operating history of the company which is significantly below debt costs of 10%+ for 102 asset mining companies. This capital cost arbitrage enhances royalty returns over owning the underlying mining company stock.

Royalty companies still have to compete with public and private markets to fund mining projects which keeps internal rates of return in check somewhat, but with the lack of asset managers in the space, future returns are on the rise.

Royalty Companies Generate Upside Three Ways

1.Exploration Success

The value of a royalty increases as more pounds of metal are discovered. While royalty companies aren’t usually the operators of a project, partner drilling and exploration success still accrues to the royalty.

As an example, owning a 1.5% royalty on a property where drilling discovers another 1 million ounces of gold = 1Moz X $2,430 X 1.5% = $36.5M of additional value accruing to the royalty. Analyst NAV estimates don’t fully account for exploration upside as a general rule making an active drilling campaign very valuable to royalty investors.

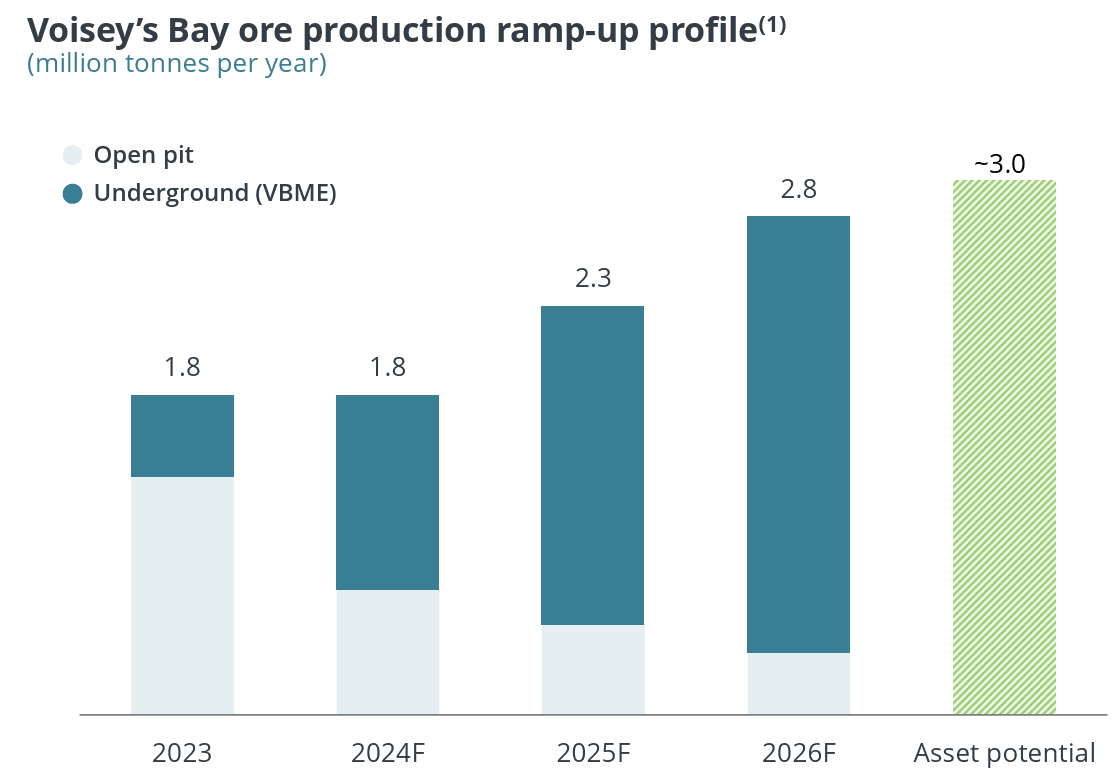

2.Accelerating Production

Both the mine operator and the royalty owner come out winners when a mine increases production above what was originally planned. The main reason ramping up production is so valuable is because of the time value of money. An ounce produced in year 30 all else equal is worth far less to us today than an ounce produced in year 5. Pulling forward production and cashflow significantly increases the value of a project to royalty holders.

3.Earning the Project’s Cost of Capital

This one is the most straightforward but also least appreciated.

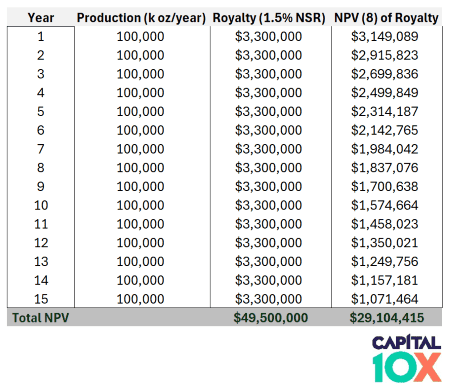

Say a royalty company trades at NAV with an 8% discount rate applied. This means if the portfolio of projects start up on time and produce as expected, you will earn an 8% return over time all else equal. Over time the gap between the undiscounted net asset value and the NAV with an 8% discount rate closes. An example will help illustrate. Say we have a mine expected to produce 100,000 oz per year for fifteen years. At $2,200/oz gold the project is worth $29.1 million to us today.

Value of a 100k oz Mine at $2,200 Gold (Year 1)

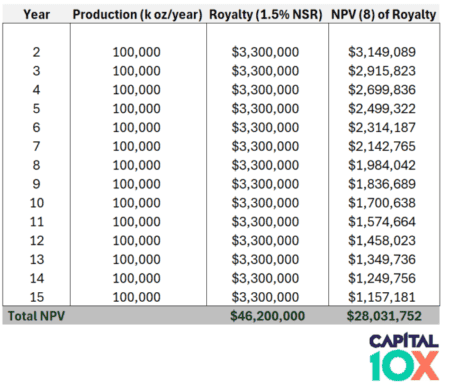

Now lets move forward in time 1 year. The mine has generated $3.3 million of royalties so it should now be worth $29.1M – $3.3M = $25.8M.

But instead the present value is now $28 million, how can this be?

As you move through time the value of future cashflows increase as the NPV approaches the total undiscounted value of the project ($46.2 million). In this example the NPV of each year gained 8%!

Value of a 100k oz Mine at $2,200 Gold (Year 2)

Who is Ecora?

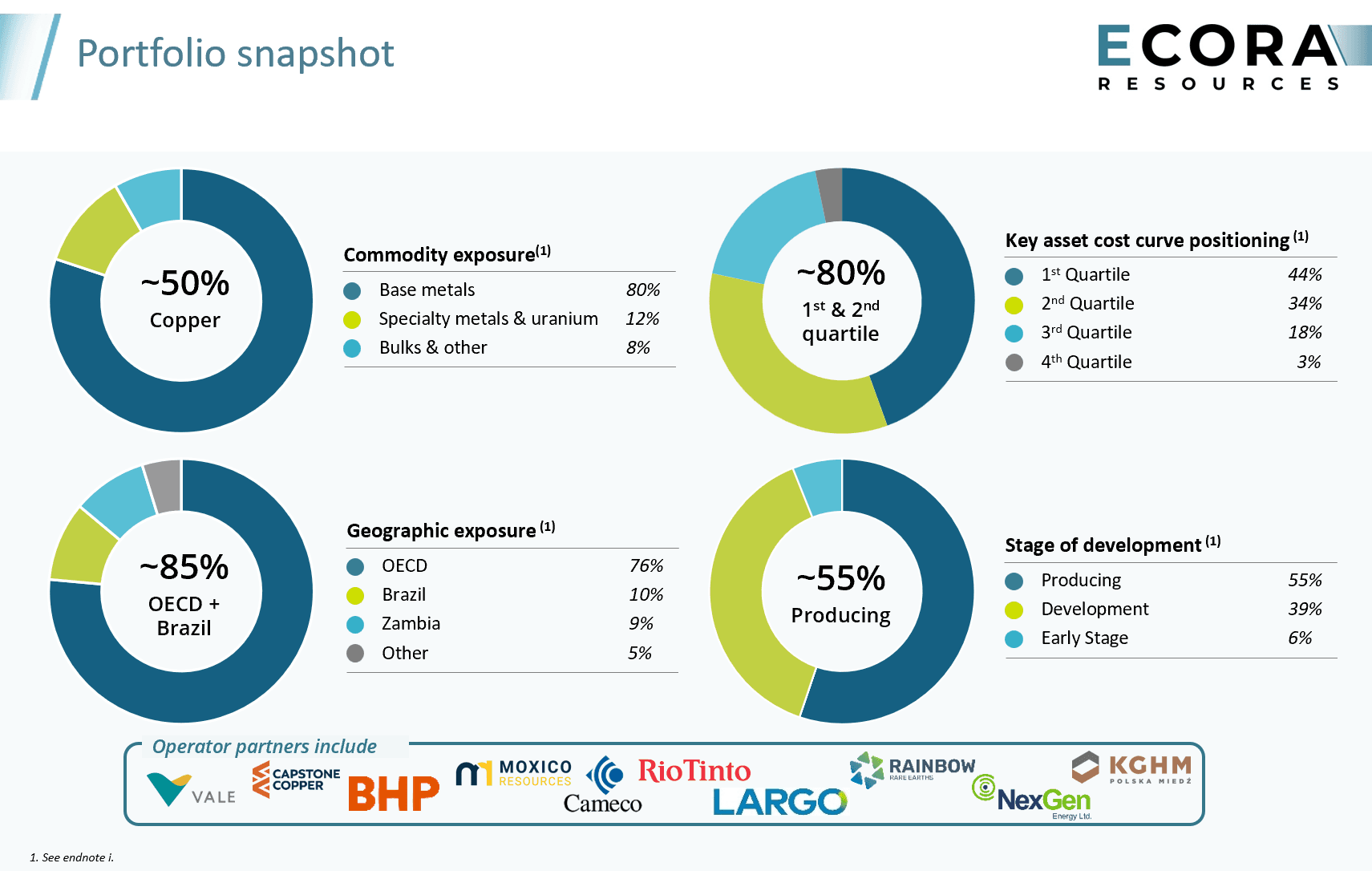

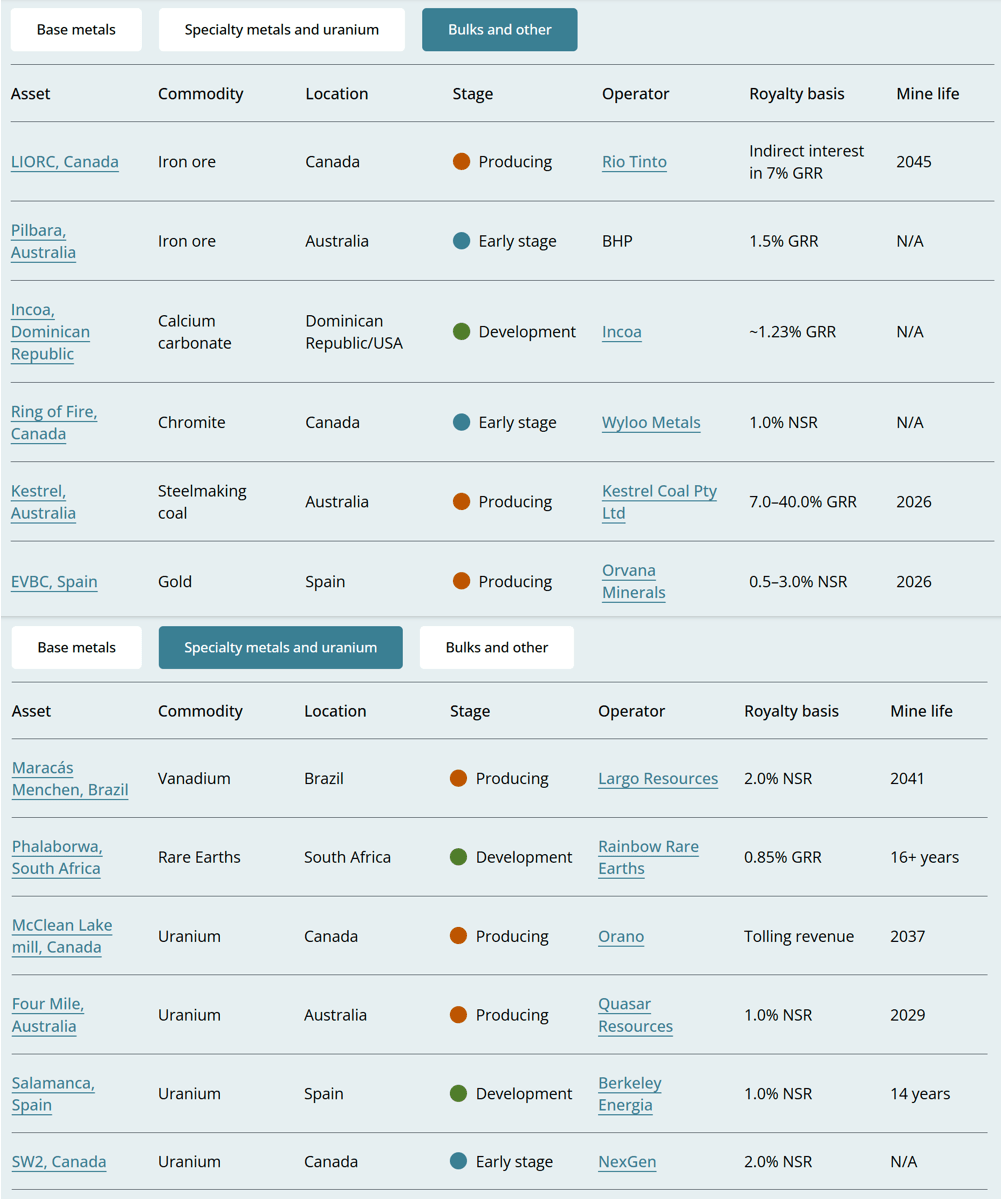

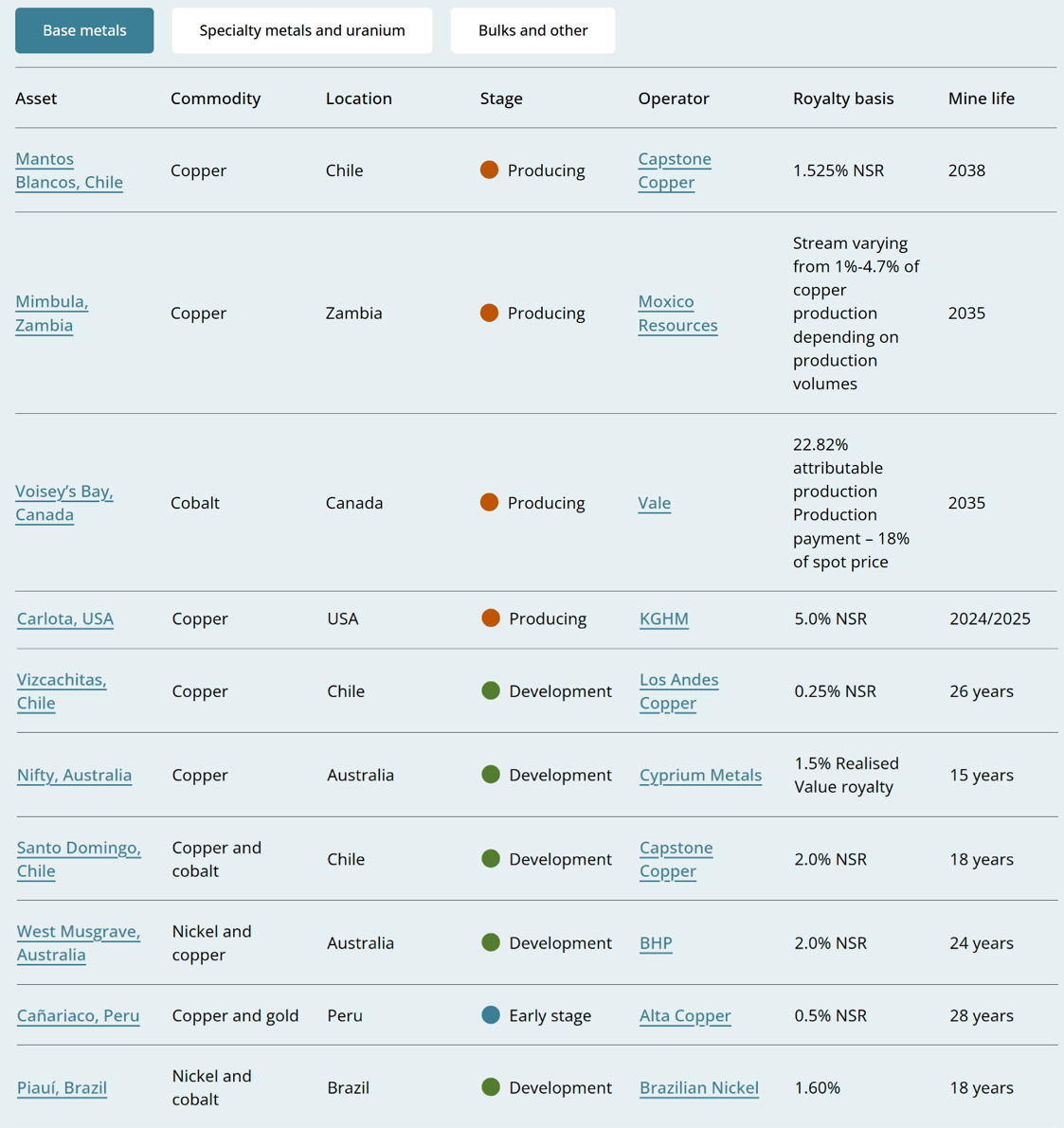

Ecora’s assets are spread out geographically and by commodity. Positively, the projects are largely concentrated in developed countries with low political risk. Political risk is one of the major but, often underappreciated risks facing commodity investors and Ecora has clearly decided to limit this risk as much as possible.

Besides the Kestrel and EVBC royalties, producing projects have attractive project lives that stretch into next decade.

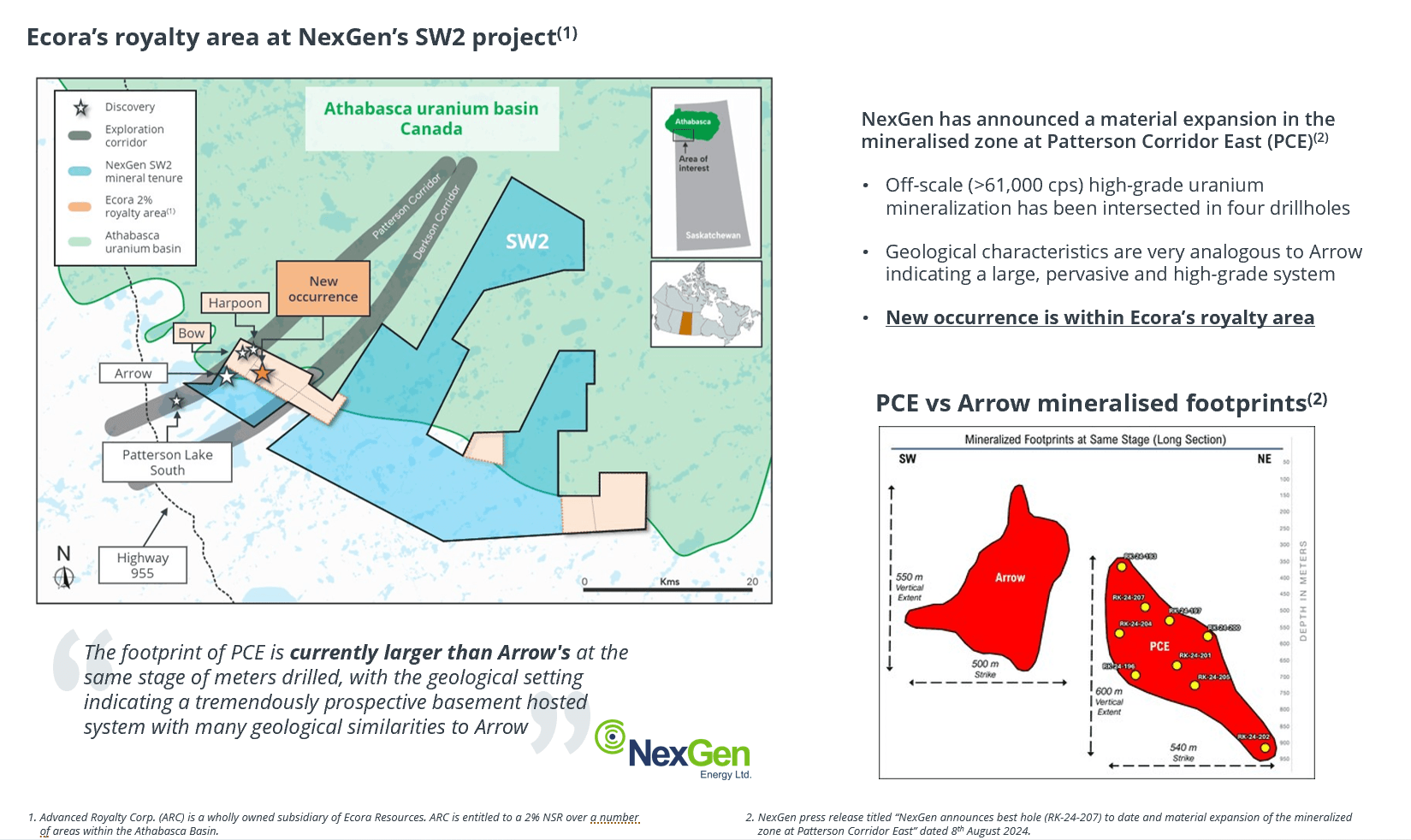

Uranium in particular is an underappreciated value driver for Ecora. Ecora owns a royalty on NexGen’s SW2 project which borders the Arrow deposit, soon to be the largest new uranium project in the world. The Rook 1 project is anticipated to supply 30 million pounds of uranium per year later this decade. For perspective, 30 million pounds is 20% of world uranium supply. Nexgen recently discovered the PCE deposit, on Ecora’s royalty, which already has the potential to be even bigger than Arrow according to Nexgen management. This royalty alone has huge potential, yet as we discuss below, is not priced in to the current stock price. Back of the envelope math would put Ecora’s royalty income at close to $50 million dollars per year if PCE eventually produces 30 million annual pounds like Rook 1.

A History of Coal But a Future Tied to Base Metals

Ecora was originally built on the back of coal. The company owned land in Queensland Australia that turned into the large and very profitable Kestrel coal mine. The mine has been producing since 1999 and today Ecora still generates close to half of earnings from the Kestrel mine.

Picture of the Kestrel Coal Mine and Processing Facility

Ecora has a strong track record of royalty income growth, with the previous CEO Julien Treger and current CEO Marc Bishop LaFleche growing income from $4.5 million dollars in 2013 all the way to $63 million today.

Management’s ongoing priority #1 is to acquire producing and soon to produce royalties to backfill income from coal, which is expected to roll off over the next two years.

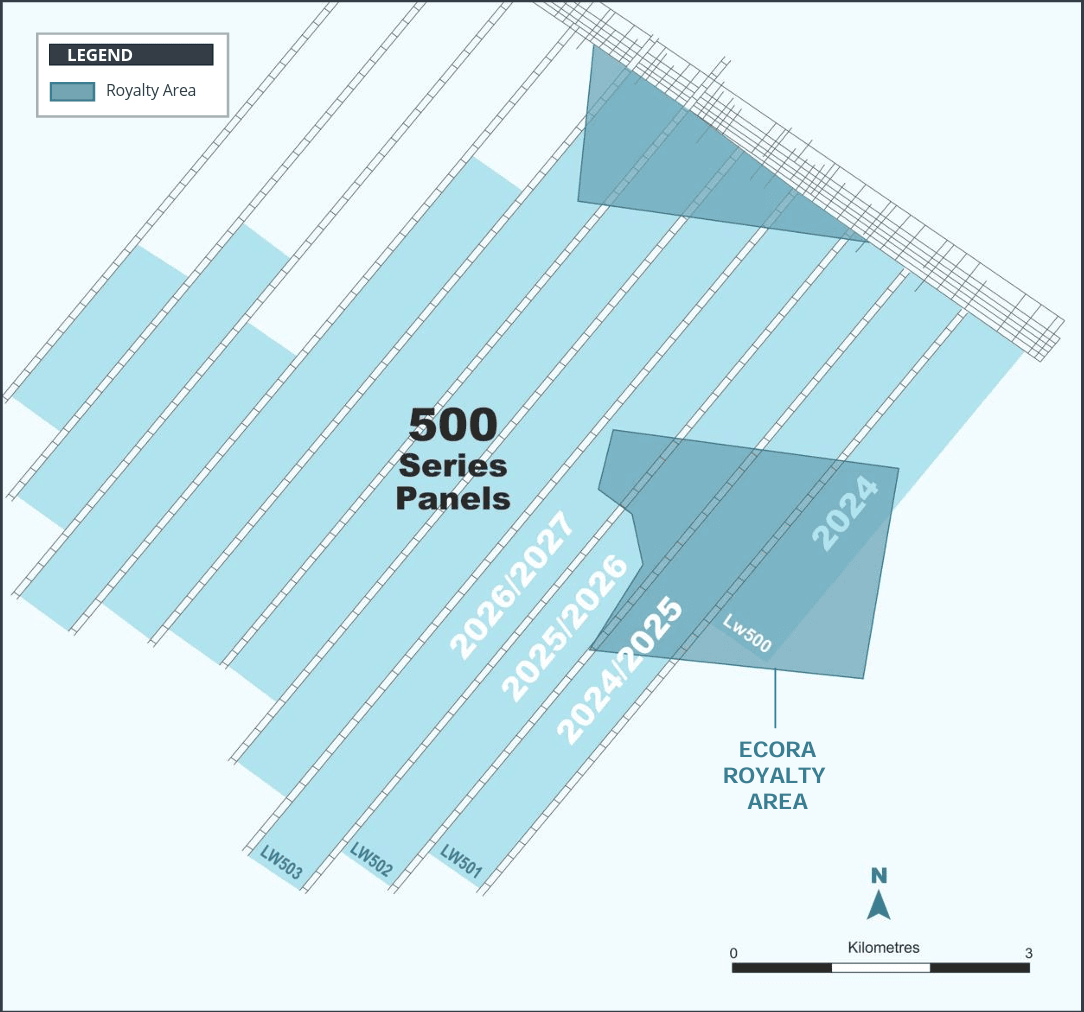

Management has been very clear to the market about the declining royalties from coal, even going so far as to provide a helpful visual of the royalty area at Kestrel so investors can better forecast when the remaining income will flow in from Kestrel.

Mining Forecast Diagram for Kestrel

2023 was the Income Trough for Ecora

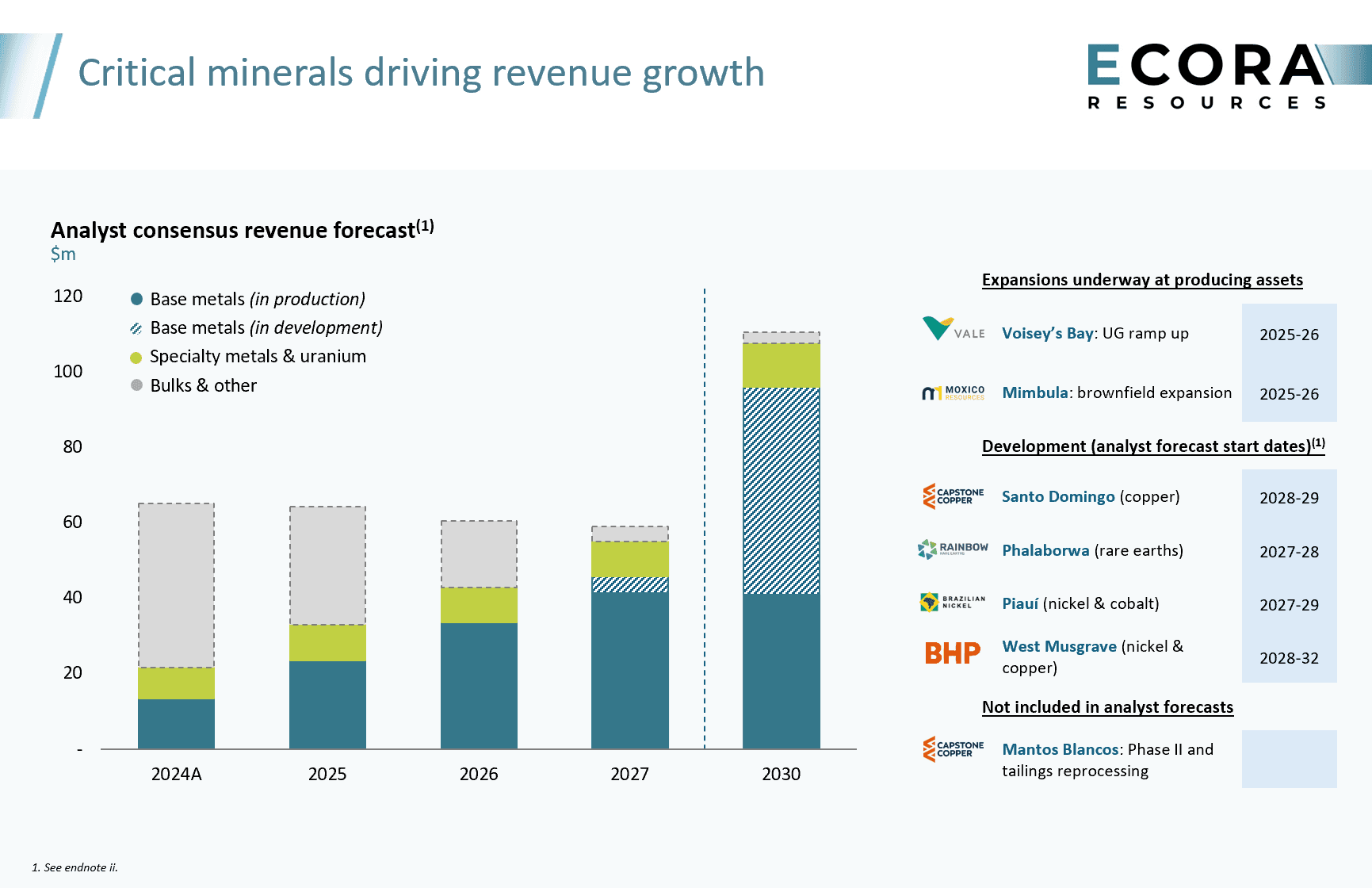

Ecora has already been successful acquiring royalties to replace Kestrel and even without additional asset purchases, management is confident royalty income can hit close to $100 million in the medium term, compared to $64 million in 2023. 2023 likely marked the royalty income trough and Ecora management is guiding to royalty volume growth in 2024 and 2025. Growth will be driven by exposure to future facing commodities such as copper, cobalt uranium and rare earths.

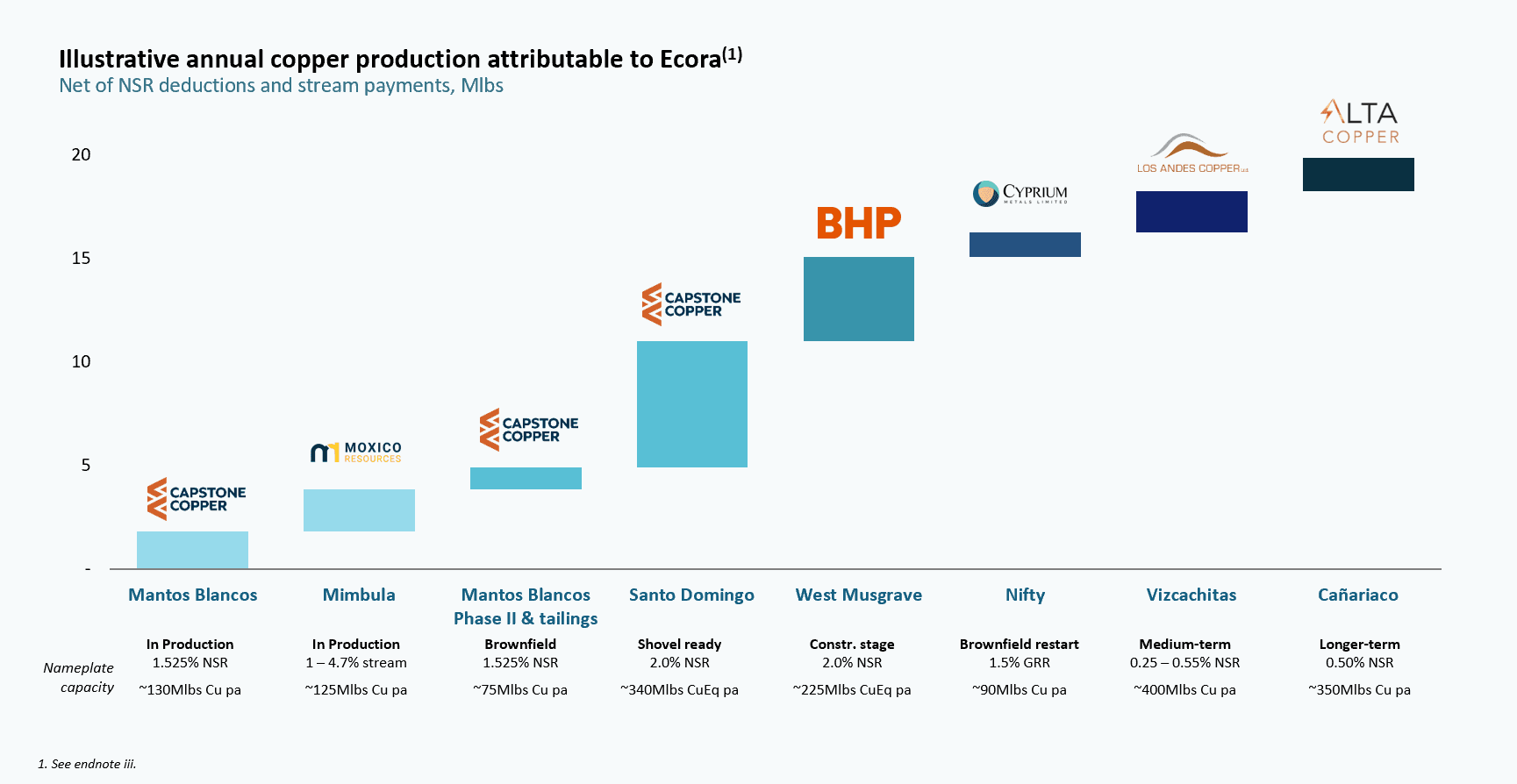

Ecora expects to replace 60%-70% of coal royalties from the upcoming Santo Domingo copper project. Santo Domingo is expected to begin construction in 2026 with production to follow the next year.

Mantos Blancos copper, currently 1/6 the royalty income of Kestrel, has near term royalty upside. Production is expected to grow 20% in 2025 with ongoing tailings and phase II expansion studies ultimately driving 50% production from 2024 levels for minimal additional capital.

The Nifty copper project will also be restarting within two years, helping to fill the royalty gap.

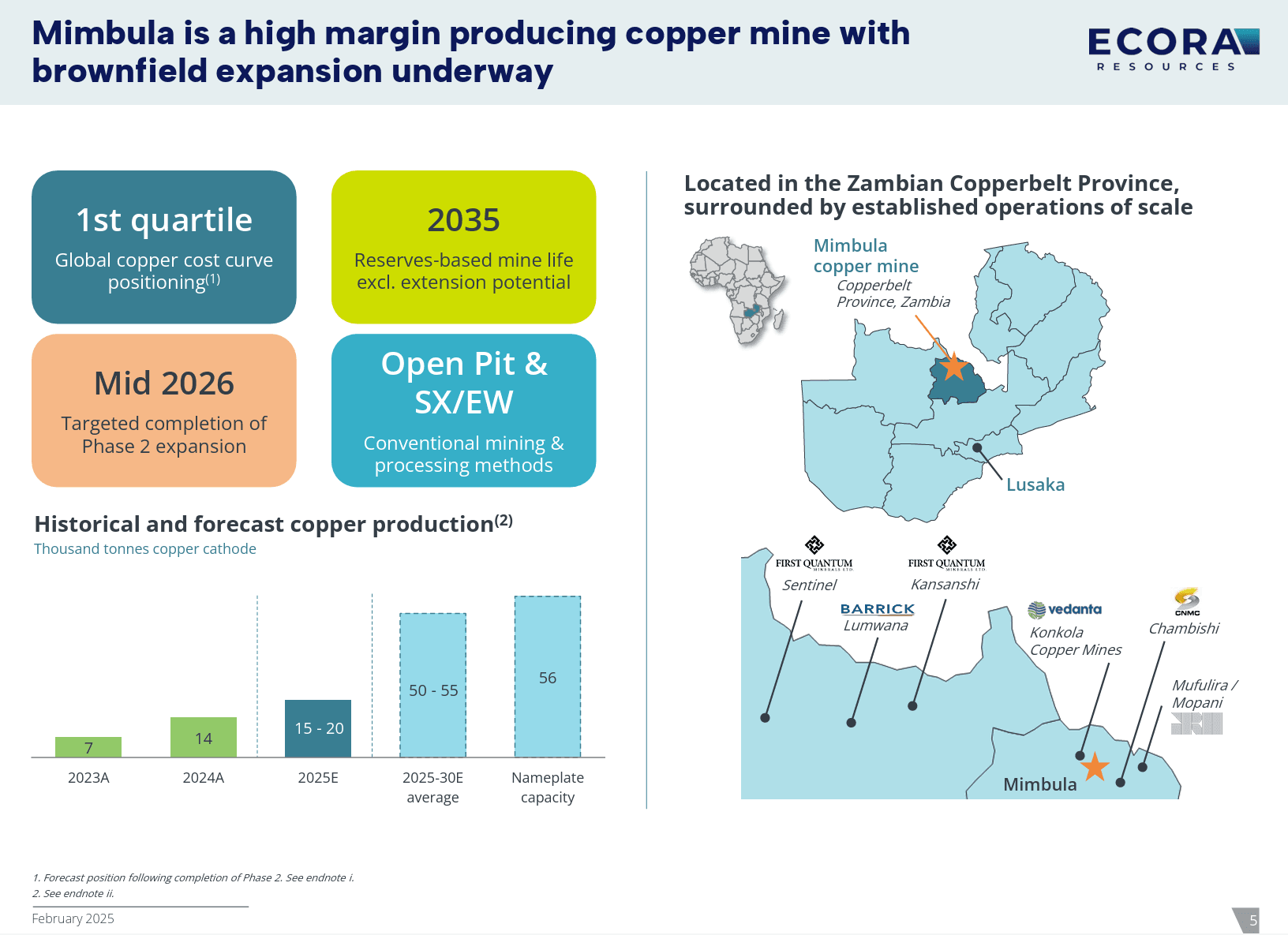

Also in February of 2025 Ecora bought a royalty on the Mimbula Copper project in Zambia which will provide near term royalty income of US$10 million per year for at least the next 7-8 years with expansion opportunities longer term.

A Laser Focus on Copper

A Culture of Deep Due Diligence

Criteria #1: The Right Commodity

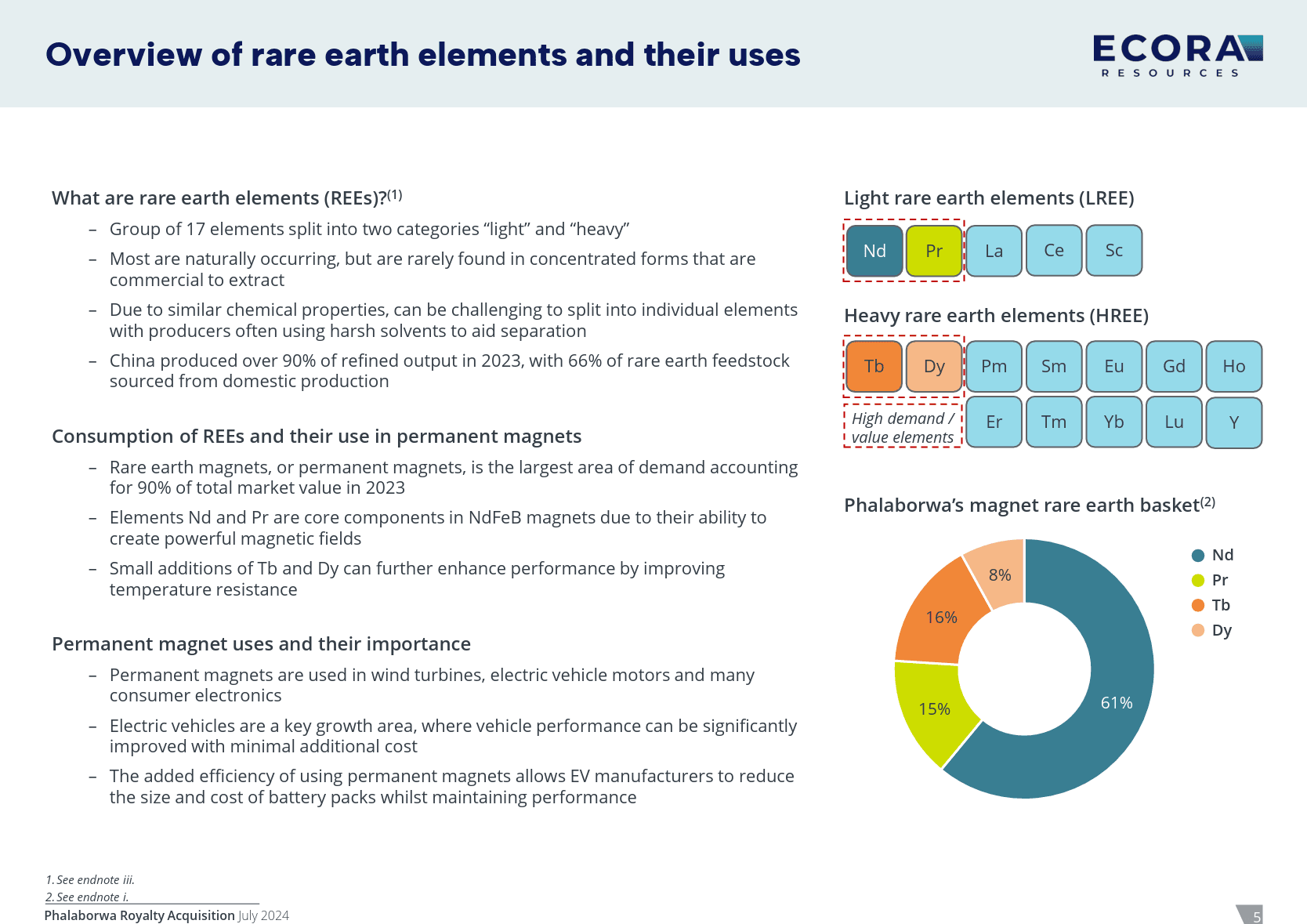

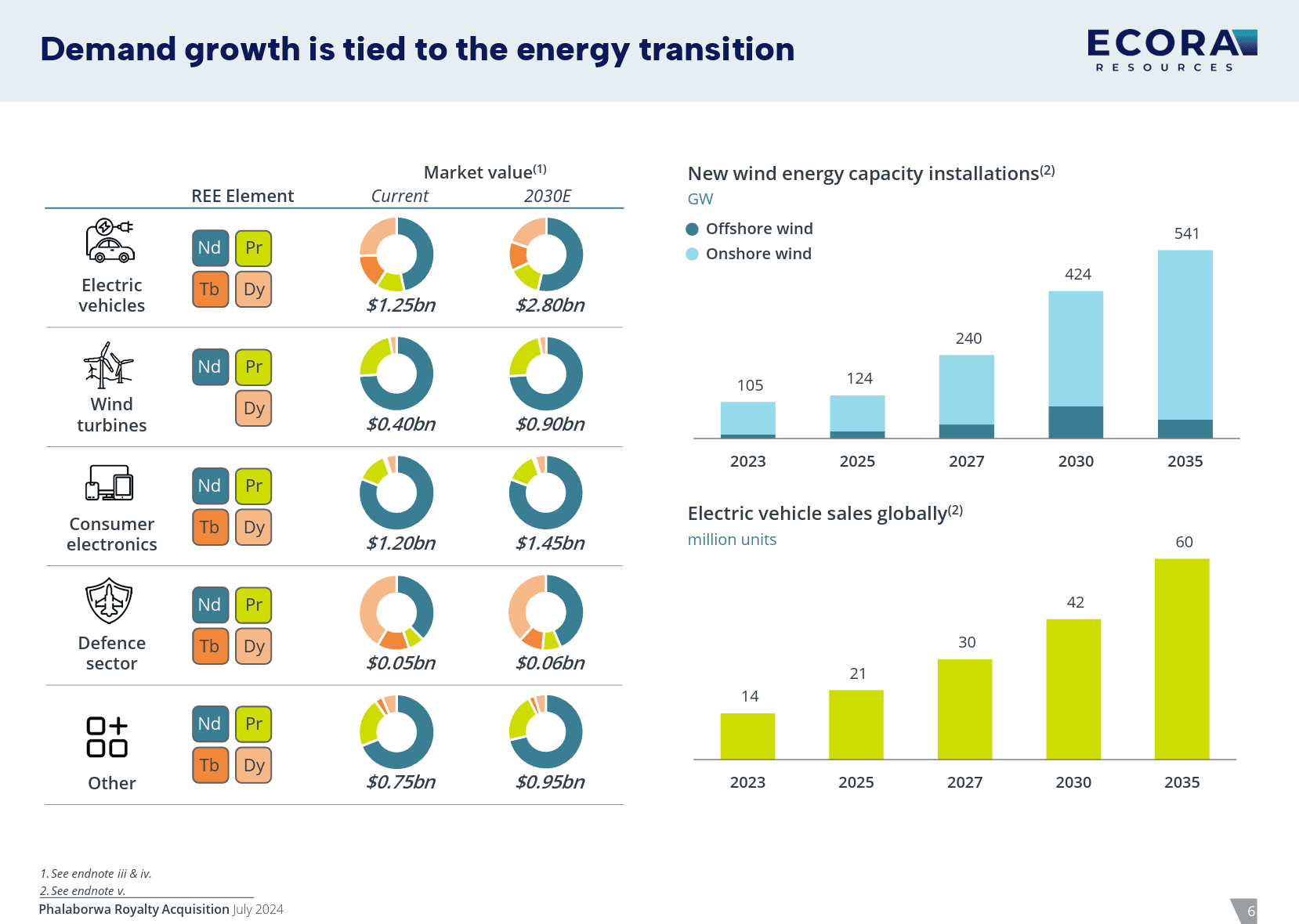

The Ecora investment team chose a rare earth royalty due to the strong macroeconomic demand trends for rare earths, the western world’s move to invest in and purchase sources of supply outside of China and the fact that the deposit contains large amounts of the four most in demand rare earths.

Criteria #2: Demand Growth

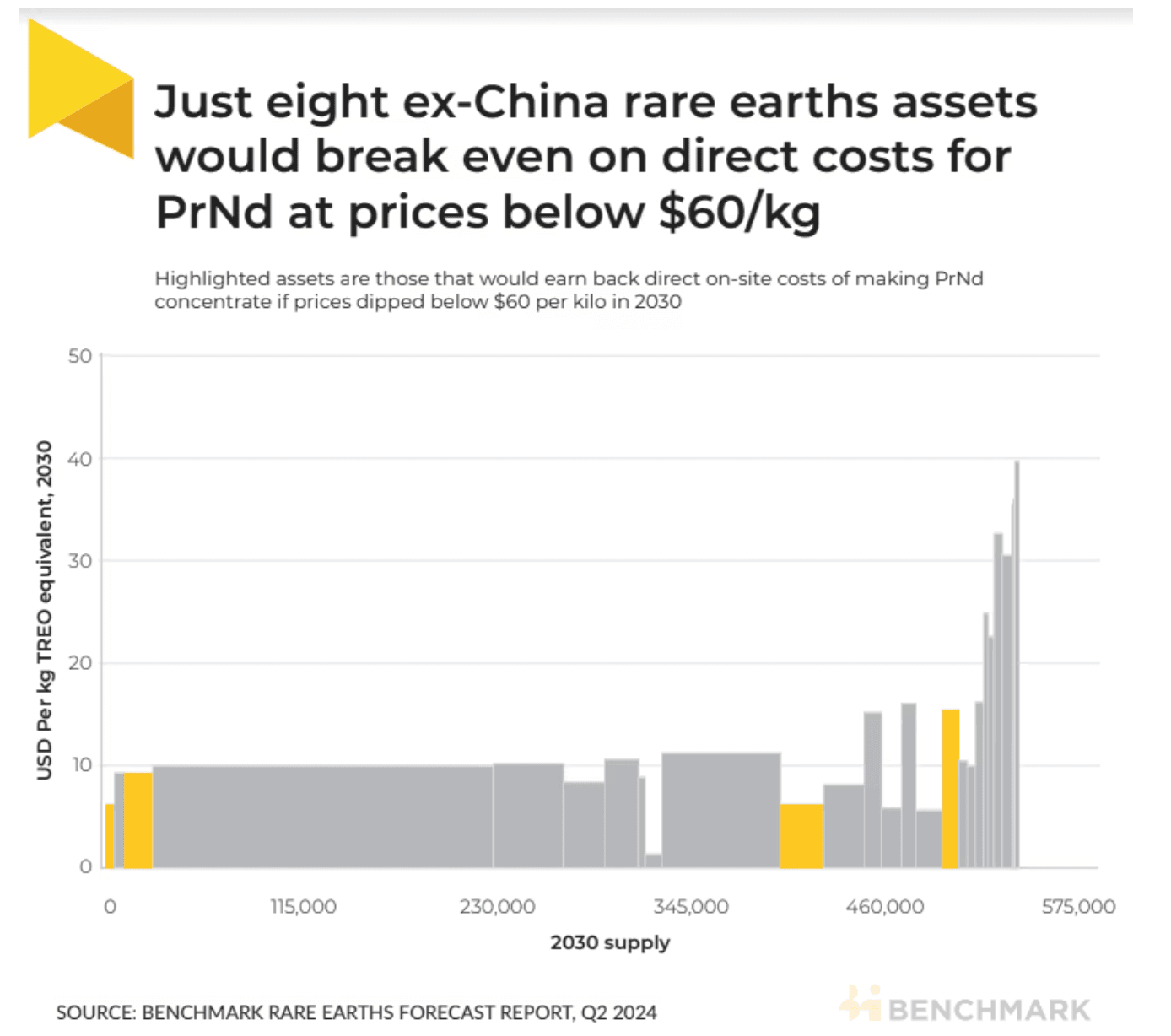

Criteria #3: Cost Curve

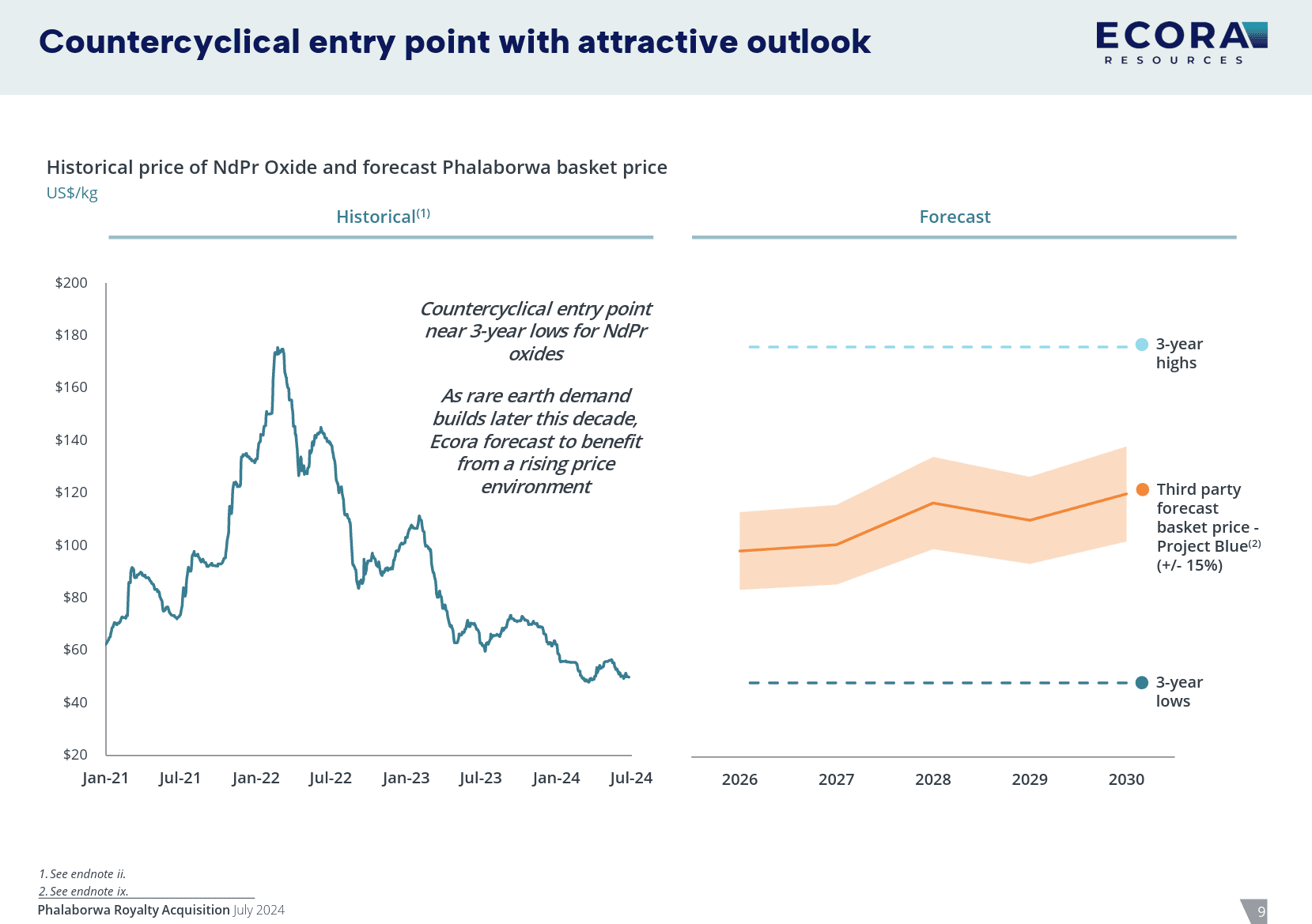

Criteria #4: Prices at Multi-year Lows, Not Highs.

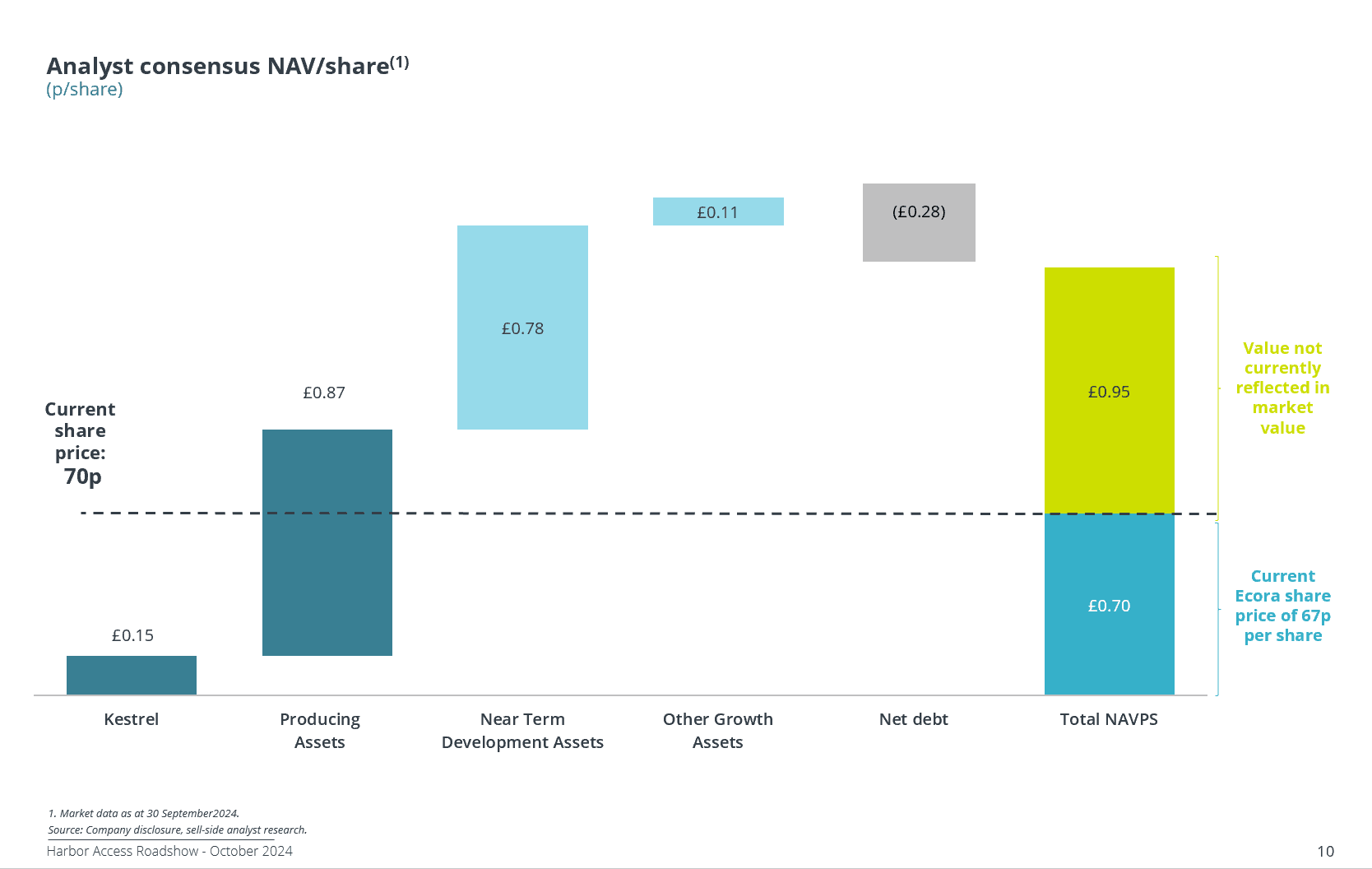

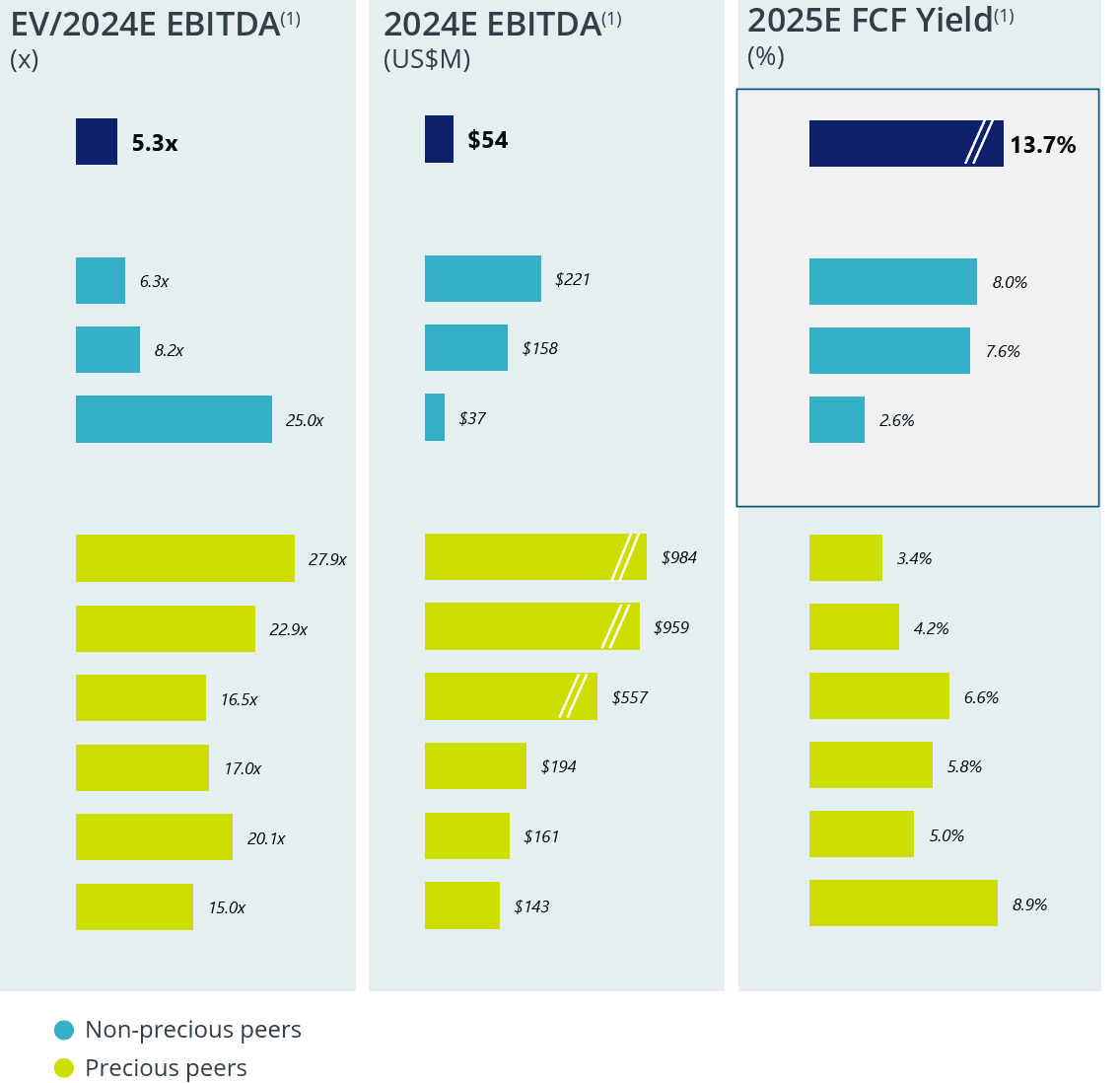

A Significant Valuation Gap to Peers

Ecora’s dramatic royalty transition is already in the works but has not yet fed through into today’s financials. For this reason, investor’s are still treating the company like a low multiple declining coal royalty company.

At the current share price of 55 pence, Ecora will be paying out a 8.6% dividend yield with a 24% free cashflow yield by the time they hit their medium term royalty goal of $90-$100 million dollars.

Bottom Line: A plan for Growth at a Big Discount

The dramatic transition Ecora is going through has created an opportunity for investors. The current financial results, when analyzed by AI or a generalist investor, paints a picture of a coal royalty company in decline. However those who dig a bit deeper will see the margin of safety Ecora potentially presents. Mispricings often last for years, but when they do close, it rarely happens slowly.

At some point in the not too distant future, Ecora is likely to report a significant quarter of non-coal royalty growth that proves income will continue to rise and the future of the company is in metals with strong demand. Soon after these numbers filter out, the company’s 60% discount to non-coal royalty peers and high and rising dividend yield will be hard to ignore.