Highlights

A$14.1M Entitlement Offer Fully Subscribed

- Completion of Entitlement Offer to all eligible shareholders, raising A$14.1M (before costs) in early

September 2025. - Proceeds from the Entitlement Offer provide funding to deliver the following key milestones in the growth

and development of Hot Chili’s Costa Fuego copper-gold project (Costa Fuego), located in the coastal

range of Chile:

o Completion of the Company’s asset-level, strategic partnering processes (Partnering Process)

(as announced 5 August 2025), and

o Commencement of phase-two diamond drilling at the La Verde copper-gold discovery (La Verde)

is expected to facilitate a maiden mineral resource estimate.

Diamond Drilling Commences at La Verde Cu-Au Porphyry Discovery

- Diamond drilling commenced in late September 2025 with one drill rig in operation on a double-shift basis.

- Phase-two drilling follows the success of the Company’s first-pass, 10,000m reverse circulation (RC) drill program, which confirmed a significant +0.2% Cu discovery footprint measuring 1,000 m by 750 m and extending up to 400 m vertical depth.

- Second phase of drilling at La Verde aims to significantly expand the initial shallow porphyry discovery with diamond drilling targeting depth extensions to higher grade centres.

- Impact modelling by Hot Chili has outlined potential for significant additional open pit material to be added to the front-end of Coast Fuego’s 20 year mine schedule, providing both mine life growth and materially enhanced financial metrics to Hot Chili’s March 2025 Pre-feasibility Study for Costa Fuego.

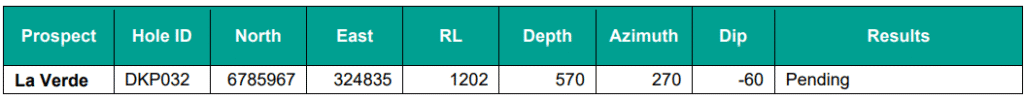

- Three diamond drill holes complete to date with results pending.

Regulatory Approval for Expansion Drilling at La Verde

- In early October 2025, the Company received approval to expand drill coverage across La Verde. This will provide access to test lateral and along-strike extensions at La Verde, as well as first-pass drilling of three look alike targets to test potential for a district-scale copper porphyry cluster.

Strategic Partnering Process Advancing

- Ongoing asset-level Partnering Process, being led by BMO Capital Markets, to introduce one or more qualified partners with the financial, technical and operational capability to assist in funding and delivering of the Company’s Costa Fuego and Huasco Water projects (as announced 5 August 2025).

- Significant additional interest received in Hot Chili’s asset-level Partnering Process during the quarter.

- Regulatory approval refers to a Sectoral Permit, which is the appropriate regulatory authorization for a project of this scale. A full DIA (Environmental Impact Declaration) would be processed in a next drilling stage following current regulations. Hot Chili remains fully committed to transparency and environmental responsibility in every stage of the project.

A$13.8M Cash and no debt

This quarter saw the commencement of the Phase 2 drilling at La Verde, located 30km south of Costa Fuego

in coastal Chile

Cautionary Statement – JORC Code (2012)

The Costa Fuego Copper-Gold Project is currently at the Pre-Feasibility Study (“PFS”) stage. The production targets and forecast financial information contained in this report are based on technical and economic assessments that are preliminary in nature. While the PFS incorporates Indicated and Inferred Mineral Resources, there is a lower level of geological confidence associated with Inferred Mineral Resources, and no certainty that further exploration or development will result in the conversion of Inferred Mineral Resources to Indicated or Measured categories.

The PFS is not a definitive study and is based on a number of assumptions, including commodity prices, capital and operating costs, metallurgical recoveries, permitting, and other factors, which are subject to change. The outcomes of the PFS should not be used as the basis for a final investment decision. Further work, including additional drilling, metallurgical testing, and detailed engineering, is required before the Company can make a decision to proceed to development.

Of the Mineral Resources scheduled for extraction in the PFS production plan, more than 99% are classified as Indicated, with the remaining <1% as Inferred. The Company has concluded that it has reasonable grounds for disclosing a production target which includes a small amount of Inferred Mineral Resources, as permitted under the JORC Code. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realized. The viability of the development scenario envisaged in the PFS does not depend on the inclusion of Inferred Mineral Resources. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to

Measured or Indicated Mineral Resource with continued drilling.

The Mineral Resources underpinning the production target in the PFS have been prepared by a Competent Person in accordance with the requirements of the JORC 2012. For full details on the Mineral Resource estimate, please refer to the ASX announcement of 27 March 2025.

To achieve the outcomes indicated in the PFS, including reaching Definitive Feasibility Study (“DFS”), mine construction and production stages, funding in the order of US$1.27 Billion will be required, including pre-production and working capital and assumed financing charges. Investors should note that that there is no certainty that Hot Chili will be able to raise that amount of funding when needed. One of the key assumptions is that the funding for the Project will be available when required and on acceptable terms. It is also possible that such funding may only be available on terms that may be dilutive to, or otherwise affect the value of, Hot Chili’s existing shares. It is also possible that Hot Chili could pursue other value realization strategies such as debt financing, a sale or partial sale of its interest in the Costa Fuego Copper Project and/or Huasco Water, sale of further royalties and/or streaming rights, sale of non-committed offtake rights, and sale of non-core

assets.

The Company cautions that there is no certainty that the results or estimates contained in the PFS will be realized.

This Report contains forward-looking statements. Hot Chili has concluded that it has a reasonable basis for providing these forward-looking statements and believes it has a reasonable basis to expect it will be able to fund development of the Costa Fuego Copper Project. However, a number of factors could cause actual results or expectations to differ materially from the results expressed or implied in the forward-looking statements. Given the uncertainties involved, investors should not make any investment decisions based solely of the results of the PFS.

Summary of Operational Activities

Diamond Drilling Commences at La Verde Cu-Au Porphyry Discovery

Diamond drilling commenced on 22 September 2025 with one drill rig in operation on a double-shift basis. This

second phase of drilling at La Verde aims to significantly expand the initial shallow porphyry discovery (Figure 1).

Phase-two drilling follows the success of the Company’s first-pass 10,000 m RC drill program, which confirmed a

significant +0.2% Cu discovery footprint measuring 1,000 m by 750 m and extending up to 400 m vertical depth.

Importantly, over half of Hot Chili’s first pass drill holes ended in significant mineralization at the capacity of RC

drilling, leaving the porphyry discovery open at depth and laterally (Figure 2).

Phase-two diamond drilling will target depth extensions to three high-grade centres confirmed in Phase one (Figure

3).

Impact modelling by Hot Chili has outlined the potential for significant additional open pit material to be added to the

front-end of Coast Fuego’s 20 year mine schedule, providing both mine life growth and materially enhanced financial

metrics to Hot Chili’s March 2025 Pre-feasibility Study for Costa Fuego.

Three diamond drill holes are already complete, with all three drill holes visually recording wide intersections of

porphyry-style copper mineralization. Assay results are pending and results will be announced to ASX following

receipt of assays.

Note: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses

where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide

no information regarding impurities or deleterious physical properties relevant to valuations.

Regulatory Green Light Paves Way for La Verde Expansion Drilling

In early October, an application to expand drill coverage across La Verde was approved. In addition, baseline studies

for a second Environmental Impact Assessment (EIA) are ongoing to ensure timely integration of La Verde into Costa

Fuego’s potential future mine plan.

This recent regulatory approval allows Hot Chili to continue expanding La Verde, providing access to test:

- Further lateral and along-strike extensions to the La Verde footprint, and

- Potential for La Verde to be part of a district-scale copper porphyry cluster, with three nearby look-alike targets

set for first-pass drilling.

Drill platform clearing is planned to start ahead of the arrival of a second RC drill rig to accelerate phase two drilling

at La Verde.

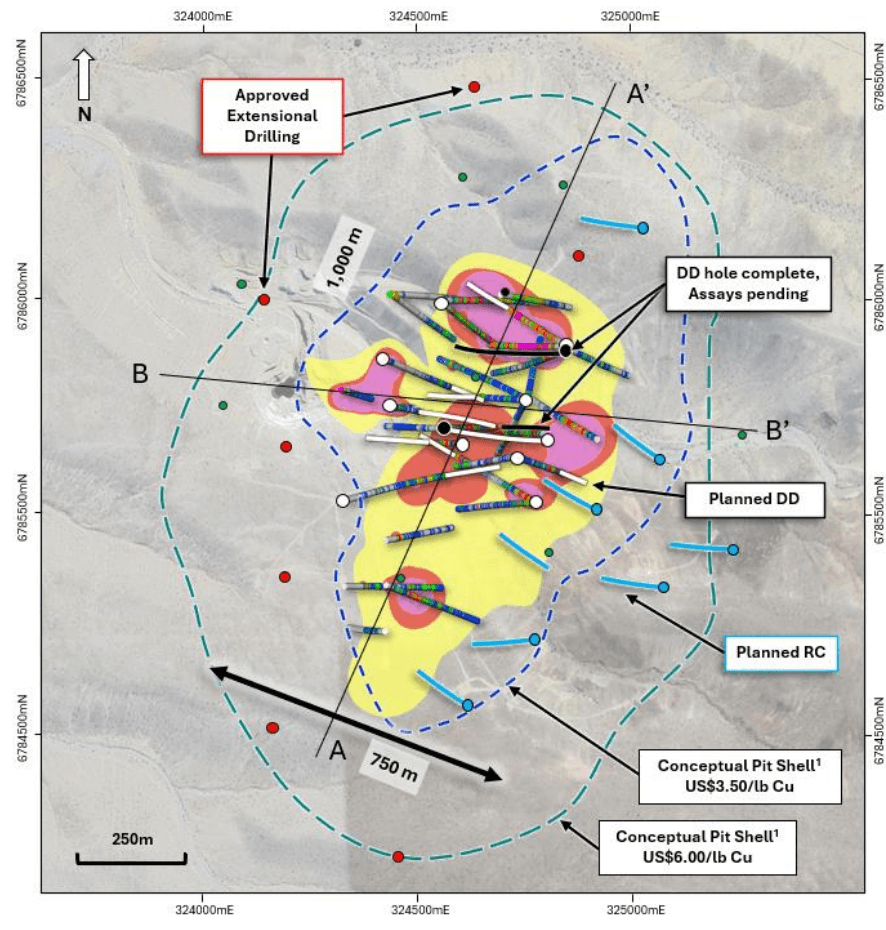

Figure 1. Plan view map of the La Verde porphyry system showing approved extensional collar locations (red

points), planned (white traces) and completed DD drilling (black) compared with +0.2% copper (yellow), +0.3%

copper (red), +0.4% copper (Magenta) mineralization interpolants from Phase one drilling. Conceptual open pit

shells1 displayed for $US3.50/lb Cu (blue) and $US6.00/lb Cu (green) displayed as dashed lines. See

announcement dated 25 September 2025 for JORC Table 1 additional technical information.

1 See Page 5 of this announcement for detail on the US$3.50 Cu and US$6.00 Cu conceptual open pit shells (Exploration Targets). Any potential tonnage and grade of the Exploration Target shown is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource within the target area, and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

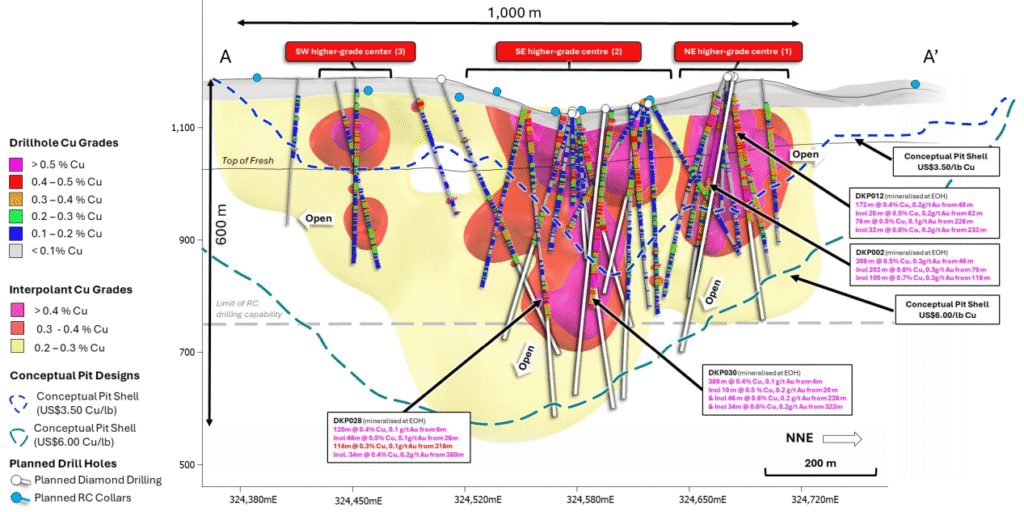

Figure 2. NNW facing longitudinal section (A – A’) of the La Verde porphyry system showing planned diamond drill hole traces, and planned RC collars compared to +0.2% copper (yellow), +0.3% copper (red), +0.4% copper (Magenta) mineralization interpolants from returned assay results. Weathering profile displayed as top of fresh material (black line). Returned Cu grades graphed downhole along hole traces (grey). Conceptual open pit shells1 displayed for $US3.50/lb Cu (blue) and $US6.00/lb Cu (green) displayed as dashed lines.

1 See Page 5 of this announcement for detail on the US$3.50 Cu and US$6.00 Cu conceptual open pit shells (Exploration Targets). Any potential tonnage and grade of the Exploration Target shown is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource within the target area, and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

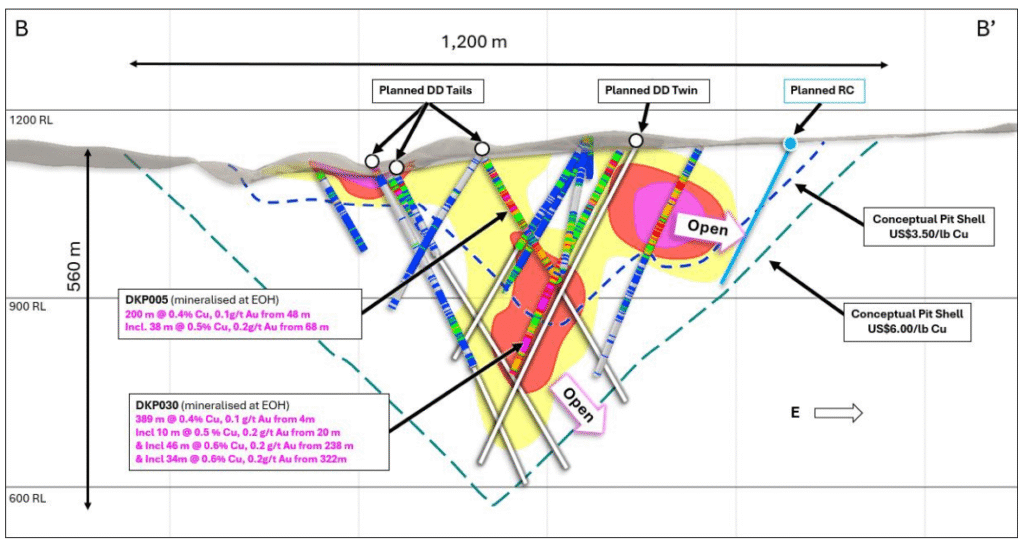

Figure 3. (Top) North facing cross section B – B’ (± 75m clipping), (Bottom) and North facing cross section C-C’ (± 75m clipping) through the La Verde porphyry system showing planned diamond and RC drill holes compared to +0.2% copper (yellow), +0.3% copper (red), +0.4% copper (Magenta) mineralization interpolants from returned assay results. Conceptual open pit shells1 displayed for $US3.50/lb Cu (blue) and $US6.00/lb Cu (green) displayed as dashed lines.

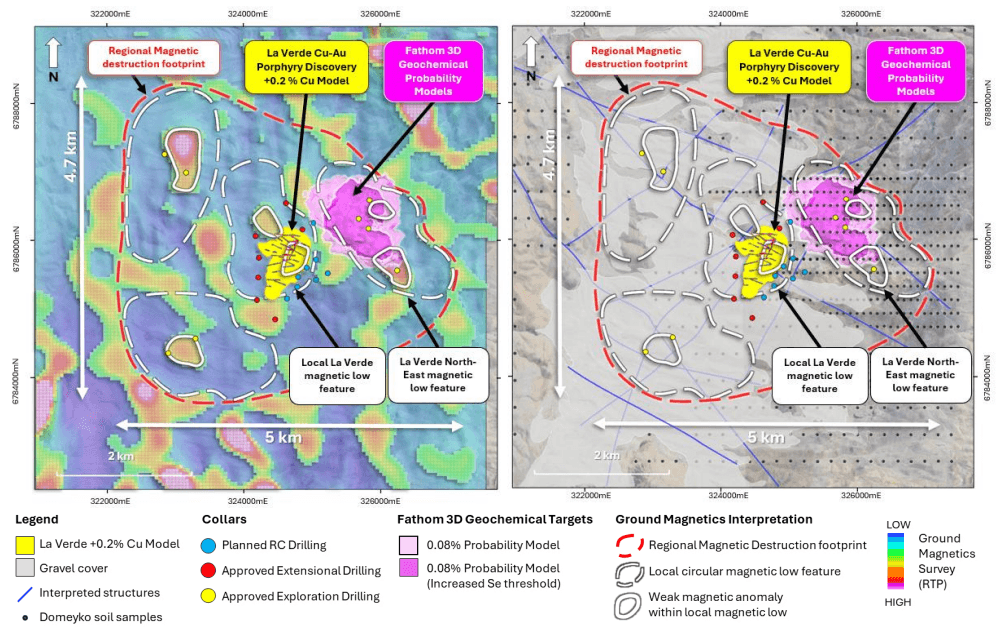

Figure 4. Plan view showing the La Verde +0.2% Cu mineralization interpolant in relation to regional magnetic

destruction footprint (red dashed), local magnetic low features (white dashed), weakly magnetic anomalies (white

line) and Fathom 3D geochemical probability models (purple isosurfaces). Left – shown overlain on reduced-to the-pole (RTP) ground magnetics. Right – shown in relation to mapped gravel cover, interpreted regional

structures and soil sample coverage. See announcement dated 29 May 2025 for JORC Table 1 additional

technical information.

Table 1 – Drill Holes Completed for Costa Fuego in Quarter 3 2025

Summary of Corporate Activities

Strategic Partnering Process Advancing

Following completion of the Pre-feasibility Studies (PFS) for Costa Fuego and Huasco Water, Hot Chili initiated an

asset-level strategic Partnering Process to introduce one or more qualified partners with the financial, technical and

operational capability to assist in funding and delivering each project.

The Partnering Process continues to progress, with no material change to the status previously reported. The

Company remains engaged in assessing a range of non-binding, indicative, incomplete and conditional proposals in

relation to potential transactions for the projects. Investors are cautioned that there is no certainty the Partnering

Process will result in a transaction or binding agreement.

The Company has received significant additional interest in its asset-level Partnering Process during the quarter.

BMO Capital Markets has been appointed as financial adviser in connection with the Partnering Process.

The Company will continue to update the market in accordance with its continuous disclosure obligations.

Hot Chili Raises A$14.1M Under Fully Subscribed Entitlements Offer

In August 2025 the Company announced it was undertaking a non-renounceable, pro rata Rights Issue (Entitlement

Offer), offering eligible shareholders 2 new fully paid ordinary shares for every 13 held as of 8 August 2025, at A$0.60

per share.

The Entitlement Offer received strong demand from Australian, Canadian and international shareholders, closing on

2 September 2025, raising A$14.1M before costs. Proceeds from the fully subscribed Entitlement Offer, in addition to existing treasury, will provide funding to be used for the completion of the Company’s asset-level strategic Partnering Process, diamond drilling at La Verde and for general working capital.

Additional ASX Disclosure Information

ASX Listing Rule 5.3.2: There was no substantive mining production and development activities during the quarter.

ASX Listing Rule 5.3.3 – Schedule of Mineral Tenements as of 30 September 2025.

The schedule of Mineral Tenements and changes in interests is appended at the end of this activities report.

ASX Listing Rule 5.3.4: Reporting under a use of funds statement in a Prospectus does not apply to the Company

currently.

ASX Listing Rule 5.3.5: Payments to related parties of the Company and their associates during the quarter per

Section 6.1 of the Appendix 5B totalled $180,000. This is comprised of directors’ salaries and superannuation of

$180,000.

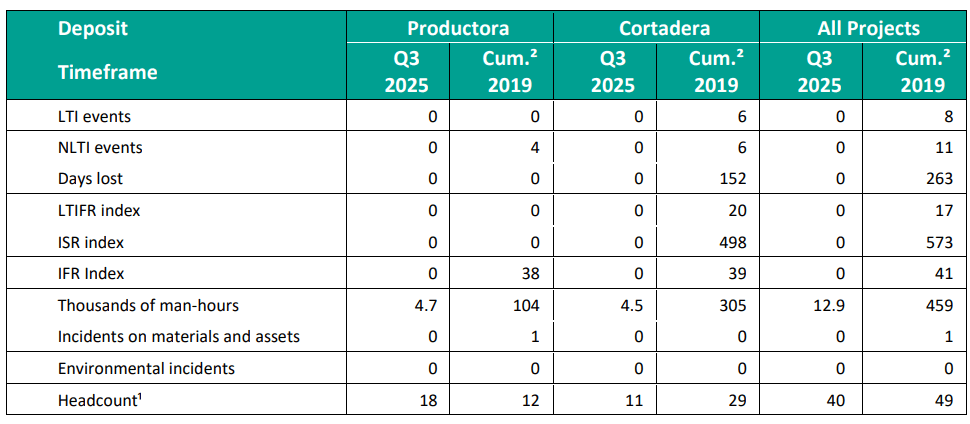

Health, Safety, Environment and Quality

Field operations during the quarter included geological reconnaissance activities, DD drilling, field mapping, and

sampling exercises across the Company’s Costa Fuego project landholdings, focussed on La Verde. Activities on

new tenements are run from the Productora or Cortadera operations centres and their safety statistics are included

under the figures for all projects.

There were no Lost Time Injuries (LTI) during the quarter.

Hot Chili’s sustainability framework ensures an emphasis on business processes that target long-term economic,

environmental and social value. The Company is dedicated to continual monitoring and improvement of health,

safety and the environmental systems. There is no greater importance than ensuring the safety of our people and

their families.

Table 2. HSEQ Quarter 3 2025 Performance and Statistics

Notes: HSEQ is the acronym for Health, Safety, Environment and Quality. LTIFR per million-manhours. Safety performance is reported on a monthly basis to the National Mine Safety Authority on a standard E-100 form; (1) Average monthly headcount (2) Cumulative statistics since April 2019.

Tenement Changes During the Quarter

During the Quarter, Sociedad Minera La Frontera SpA (Frontera SpA) has claimed 2 mining exploration concessions

(CF Sur 36 and CF Sur 37) and 2 mining exploitation concessions Cortadera Project Tenements

The Company’s existing tenements are detailed in full at the following LINK

Qualifying Statements

The scientific and technical information relating to the Company’s Costa Fuego project in this report has been derived from

or is based on the Costa Fuego Copper project pre-feasibility study (the “Costa Fuego PFS” or 2025 PFS), which has been

prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) and Joint Ore Reserves Committee of the Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the

Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (the

“JORC Code”) and reviewed and approved by the “Qualified Persons” as defined under NI 43-101 and “Competent Persons” as defined under the JORC Code, as set out below. The 2025 PFS was compiled by the Qualified Persons and Competent Persons listed below based on information available up to the effective date of the PFS. Additional details of responsibilities are provided at page 48 of presentation “Costa Fuego Preliminary Feasibility Study March 2025” released on 27 March 2025.

Conceptual Open Pit Shells

Conceptual open pit shells represent Exploration Targets as defined in the 2012 Edition of the ‘Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). They are based on completed

exploration activities reported in the announcement released 19 May 2025 (‘Hot Chili Announces Latest Drill Results for La

Verde, Doubling Porphyry Discovery Footprint’).

The conceptual open pit shells were generated using copper (Cu) prices of US$3.50/lb Cu and US$6.00/lb Cu on a series

of nested Cu grade shells. Other input parameters informing the conceptual open-pit shells (pit slope angles, mining cost,

processing cost, etc.) were derived from values reported in the March 2025 Costa Fuego Pre-feasibility Study and are

considered appropriate for the style of mineralisation encountered at the La Verde Cu-Au porphyry discovery.

Any potential quantity and grade of the Exploration Target shown is conceptual in nature. There has been insufficient

exploration to estimate a Mineral Resource within the target area, and it is uncertain if further exploration will result in the

estimation of a Mineral Resource.

Further exploration activities are detailed in this announcement and include (but may not necessarily be limited to) a

program of diamond drillholes aiming to extend the mineralised footprint at La Verde. Drilling commenced on 22 September

2025, with the length of the program dependent on a number of considerations including (but not limited to) the results of

the exploration activities and regulatory applications and approvals.

PFS Technical Report

For readers to fully understand the information in this report, they should read the PFS Technical Report available on

SEDAR+ (www.sedarplus.ca) and at www.hotchili.net.au in its entirety titled “Costa Fuego Project, Chile, Preliminary

Feasibility Study NI 43-101 Technical Report” dated 9 May 2025 with an effective date of 27 March 2025, including all

qualifications, assumptions, limitations and exclusions. The PFS Technical Report is intended to be read as a whole, and

sections should not be read or relied upon out of context. The technical information in this report is subject to the

assumptions and qualifications to be contained in the PFS Technical Report. The PFS Technical Report replaces and

supersedes the technical report titled “Costa Fuego Copper Project – NI 43-101 Technical Report Mineral Resource

Estimate Update” dated 8 April 2024, with an effective date of 26 February 2024 (the “2024 PEA”).

Qualified Persons – NI 43-101

The PFS was compiled by Wood Australia Pty Ltd with contributions from a team of independent “Qualified Persons” within the meaning of NI 43 -101. The scientific and technical information contained in this report pertaining to Costa Fuego has been reviewed and verified by the following independent qualified persons within the meaning of NI 43-101:

- Ms Elizabeth Haren (FAUSIMM (CP) & MAIG) of Haren Consulting – Mineral Resource Estimate

- Mr Dean David (FAUSIMM (CP)) of Wood Pty Ltd – Metallurgy

- Mr Piers Wendlandt (PE) of Wood Pty Ltd – Market Studies and Contracts, Economic Analysis

Mr David Cuello (MAUSIMM) of GMT Servicios de Ingeniería – Geotechnical

- Mr Jeffrey Stevens (Pr. Eng, MSAIMM) of Wood Pty Ltd – Infrastructure and Capital Cost

- Mr Luis Bernal (Comisión Minera (PC) Registered Member) of Process Mineral Consulting – Leaching

- Mr Anton von Wielligh (FAUSIMM) of ABGM Consulting Pty Ltd – Mine Planning and Scheduling

- Mr Edmundo LaPorte (PE, PEng, CPEng, SME Registered Member) of High River Services – Environmental

The above independent Qualified Persons have verified the information disclosed herein, including the sampling,

preparation, security, and analytical procedures underlying such information.

Competent Persons – JORC

The information in this report that relates to Mineral Resources, Exploration Results, and Ore Reserves for the Costa Fuego Project is based on information compiled by: - Ms Elizabeth Haren (FAUSIMM (CP) & MAIG) who is a full-time employee of Haren Consulting – Mineral Resource Estimate

- Mr Dean David (FAUSIMM (CP)) who is a full-time employee of Wood Pty Ltd – Metallurgy

- Mr Piers Wendlandt (PE) who is a full-time employee of Wood Pty Ltd – Market Studies and Contracts, Economic

Analysis - Mr David Cuello (MAUSIMM) who is a full-time employee of GMT Servicios de Ingeniería – Geotechnical

- Mr Jeffrey Stevens (Pr. Eng, MSAIMM) who is a full-time employee of Wood Pty Ltd – Infrastructure and Capital

Cost - Mr Luis Bernal (Comisión Minera (PC) Registered Member) who is a full-time employee of Process Mineral

Consulting – Leaching - Mr Anton von Wielligh (FAUSIMM) who is a full-time employee of ABGM Consulting Pty Ltd – Mine Planning and

Scheduling - Mr Edmundo LaPorte (PE, PEng, CPEng, SME Registered Member) who is a full-time employee of High River

Services – Environmental - Mr Christian Easterday (MAIG), who is the Managing Director and is a full-time employee of Hot Chili Limited –

Exploration Results

Ms Haren, Mr David, Mr Wendlandt, Mr Cuello, Mr Stevens, Mr Bernal, Mr LaPorte, Mr Easterday, and Mr von Wielligh

each have sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration

and to the activities undertaken, to qualify as a Competent Person as defined in the JORC Code and as Qualified Persons

under NI43-101.

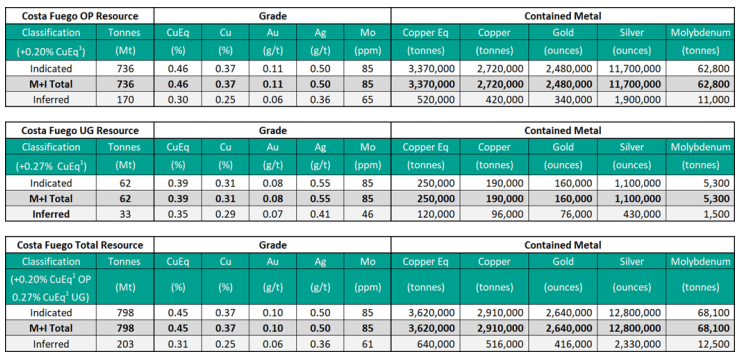

Mineral Resource Statement

Costa Fuego Combined Mineral Resource (Effective Date 26 February 2024)

1) Mineral Resources are reported on a 100% Basis – combining Mineral Resource Estimates for the Cortadera, Productora, Alice and San Antonio deposits. All figures are rounded, reported to appropriate significant figures and reported in accordance with the Joint Ore Reserves Committee Code (2012) and NI 43-101. Mineral Resource estimation practices are in accordance with CIM Estimation of Mineral Resource and Mineral Reserve Best Practice Guidelines (29 November 2019) and reported in accordance CIM Definition Standards for Mineral Resources and Mineral Reserves (10 May 2014) that are incorporated by reference into NI 43-101.

2 Mineral Resources are inclusive of the Mineral Reserve

3 The Productora deposit is 100% owned by Chilean incorporated company Sociedad Minera El Aguila SpA (SMEA). SMEA is a joint venture (JV) company – 80% owned by Sociedad Minera El Corazón SpA (a 100% subsidiary of Hot Chili), and 20% owned by Compañía Minera del Pacífico S.A (CMP).

4 The Cortadera deposit is controlled by a Chilean incorporated company Sociedad Minera La Frontera SpA (Frontera). Frontera is a subsidiary company – 100% owned by Sociedad Minera El Corazón SpA, which is a 100% subsidiary of Hot Chili.

5 The San Antonio deposit is controlled through Frontera (100% owned by Sociedad Minera El Corazón SpA, which is a 100% subsidiary of Hot Chili Liited) and Frontera is party to an Option Agreement pursuant to which it can earn a 100% interest in the property.

6 The Mineral Resource Estimates (MRE) in the tables above form coherent bodies of mineralization that are considered amenable to a combination of open pit and underground extraction methods based on the following parameters: Base Case Metal Prices: Copper US$ 3.00/lb, Gold US$ 1,700/oz, Molybdenum US$ 14/lb, and Silver US$20/oz.

7 All MRE were assessed for Reasonable Prospects of Eventual Economic Extraction (RPEEE) using both Open Pit and Block Cave Extraction mining methods at Cortadera and Open Pit mining methods at the Productora, Alice and San Antonio deposits.

8 Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. Process recoveries: Cortadera – Weighted recoveries of 82% Cu, 55% Au, 81% Mo and 36% Ag. CuEq(%) = Cu(%) + 0.55 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t). San Antonio – Weighted recoveries of 85% Cu, 66% Au, 80% Mo and 63% Ag. CuEq(%) = Cu(%) + 0.64 x Au(g/t) + 0.00044 x Mo(ppm) + 0.0072 x Ag(g/t) Alice – Weighted recoveries of 81% Cu, 47% Au, 52% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.48 x Au(g/t) + 0.00030 x Mo(ppm) + 0.0044 x Ag(g/t). Productora – Weighted recoveries of 84% Cu, 47% Au, 48% Mo and 18% Ag. CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm) + 0.0021 x Ag(g/t). Costa Fuego – Recoveries of 83% Cu, 53% Au, 71% Mo and 26% Ag. CuEq(%) = Cu(%) + 0.53 x Au(g/t) + 0.00040 x Mo(ppm) + 0.0030 x Ag(g/t)

9 Copper Equivalent (CuEq) grades are calculated based on the formula: CuEq% = ((Cu% × Cu price 1% per tonne × Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1% per tonne × Cu recovery). The base case cut-off grade for Mineral Resources considered amenable to open pit extraction methods at the Cortadera, Productora, Alice and San Antonio deposits is 0.20% CuEq, while the cut-off grade for Mineral Resources considered amenable to underground extraction methods at the Cortadera deposit is 0.27% CuEq. It is the Company’s opinion that all the elements included in the CuEq calculation have a reasonable potential to be recovered and sold.

10 Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The MRE include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred mineral resources could be upgraded to Measured or Indicated Mineral Resources with continued exploration.

11 The effective date of the MRE is 26 February 2024. The MRE was previously reported in the 2024 PEA. Hot Chili Limited confirms it is not aware of any new information or data that materially affects the information included in the 2024 PEA and all material assumptions and technical parameters stated for the MRE in the 2024 PEA continue to apply and have not materially changed.

12 Hot Chili Limited is not aware of political, environmental, or other risks that could materially affect the potential development of the Mineral Resources other than as disclosed in the 2025 PFS. A detailed list of Costa Fuego Project risks is included in Chapter 25 of the 2025 PFS Technical Report titled “Costa Fuego Copper Project NI43-101 Technical Report Preliminary Feasibility Study” and dated 9 May 2025 (effective 27 March 2025), is available on SEDAR+ (www.sedarplus.ca) and the Company’s website (www.hotchili.net.au).

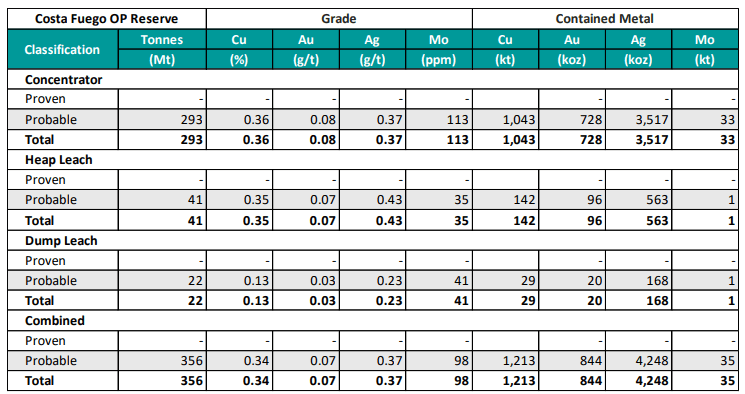

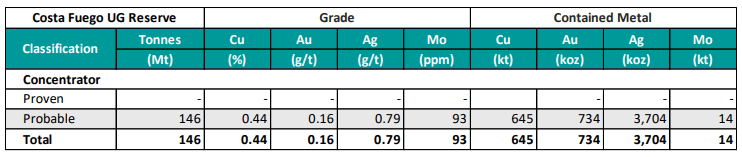

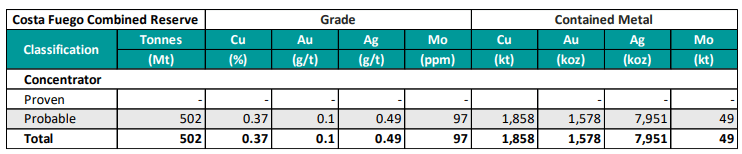

Ore Reserve Statement

Costa Fuego Combined Ore Reserve (Effective Date 27 March 2025)

1 Mineral Reserves are reported on a 100% Basis – combining Mineral Reserve estimates for the Cortadera, Productora, Alice and SanAntonio deposits, an d have an effective date of 27 March 2025.

2 An Ore Reserve (declared in accordance with JORC Code 2012) was previously reported at Productora, a component of Costa Fuego, on 2nd March 2016 on the ASX. The Company was not subject to the requirements of NI 43-101 at that time.

3 Mineral Reserve estimation practices are in accordance with CIM Estimation of Mineral Resource and Mineral Reserve Best Practice Guidelines (29 November 2019) and reported in accordance CIM Definition Standards for Mineral Resources and Mineral Reserves (10 May 2014) that are incorporated by reference into NI 43-101. Mineral Reserve estimates are in accordance with the JORC Code. References to “Mineral Reserves” mean “Ore Reserves” as defined in the JORC Code and references to “Proven Mineral Reserves” mean “Proved Ore Reserves” as defined in the JORC Code.

4 The Mineral Reserve reported above was not additive to the Mineral Resource. The Mineral Reserve is based on the 26 February 2024 Mineral Resource.

5 Tonnages and grades are rounded to two significant figures. All figures are rounded, reported to appropriate significant figures and reported in accordance with the Joint Ore Reserves Committee Code (2012) and NI 43-101. As each number is rounded individually, the table may show apparent inconsistencies between the sum of rounded components and the corresponding rounded total.

6 Mineral Reserves are reported using long-term metal prices of US$4.30/lb Cu, US$2,280/oz Au, US$27/oz Ag, US$20/lb Mo.

7 The Mineral Reserve tonnages and grades are estimated and reported as delivered to plant (the point where material is delivered to the processing facility) and is therefore inclusive of ore loss and dilution. Tonnes Cu Au Ag Mo Cu Au Ag Mo

(Mt) (%) (g/t) (g/t) (ppm) (kt) (koz) (koz) (kt)

8 The Productora deposit is 100% owned by Chilean incorporated company Sociedad Minera El Aguila SpA (SMEA). SMEA is a joint venture (JV) company – 80% owned by Sociedad Minera El Corazón SpA (a 100% subsidiary of Hot Chili), and 20% owned by Compañía Minera del Pacífico S.A (CMP).

9 The Cortadera deposit is controlled by a Chilean incorporated company Sociedad Minera La Frontera SpA (Frontera). Frontera is a subsidiary company – 100% owned by Sociedad Minera El Corazón SpA, which is a 100% subsidiary of Hot Chili.

10 The San Antonio deposit is controlled through Frontera (100% owned by Sociedad Minera El Corazón SpA, which is a 100% subsidiary of Hot Chili) and Frontera is party to an Option Agreement pursuant to which it can earn a 100% interest in the property.

11 The Mineral Reserve Estimate as of 27 March 2025 for Costa Fuego was prepared by Anton von Wielligh, Fellow with the AUSIMM (FAUSIMM). Mr. von Wielligh fulfils the requirements to be a “Qualified Person” within the meaning of NI 43-101 and is the Competent Person under JORC for the Mineral Reserve.

12 Hot Chili Limited is not aware of political, environmental, or other risks that could materially affect the potential development of the Mineral Reserves other than as disclosed in the 2025 PFS. A detailed list of Costa Fuego Project risks is included in Chapter 25 of the 2025 PFS Technical Report titled “Costa Fuego Copper Project NI43-101 Technical Report Preliminary Feasibility Study” and dated 9 May 2025 (effective 27 March 2025), is available on SEDAR+ (www.sedarplus.ca) and the Company’s website (www.hotchili.net.au).

Hot Chili is a market awareness client of Capital 10X. For more information, including potential conflicts of interest please see our Content Disclaimer.