Bottom Line: Ecora is a royalty company going through a rapid transition from a royalty business built on coal, to one completely driven by critical minerals. Ecora offers some of the highest earnings growth in the royalty space while still trading at a discount to peers with similar commodity exposure.

Key Highlights

- Non-Coal Royalty income equaled coal royalties in the quarter. On a trailing twelve month basis, coal royalties are down to 33% of total royalty income.

- Non-coal royalty income increased 175% YoY and reached a new all time high

- Cobalt volume guidance increased 17% for 2025

- Debt down 30% since the beginning of the year, opening up room for royalty acquisition or increased shareholder payouts in our view.

Marc Bishop Lafleche, Chief Executive Officer of Ecora, commented:

“Q3 was a record quarter in many respects. Our base metals portfolio maintained its strong momentum

delivering its highest ever contribution of $9.9 million, up 150% YTD compared to the same period in 2024,

with record quarterly contributions from the Mantos Blancos copper royalty and Voisey’s Bay cobalt

stream. Following strong operational performance, we are upgrading our FY 2025 volume guidance for

Voisey’s Bay.

“This strong performance, combined with the sale of the Dugbe royalty and mining returning to our private

royalty area at Kestrel, enabled us to accelerate our deleveraging. Period end net debt, including Q3 royalty

receivables due in October, was $87 million, down ~30% since the $50 million Mimbula copper stream

acquisition in Q1, and similar to year-end 2024 levels.

“We were pleased to see the recent announcement by Capstone Copper of a JV partner for their Santo

Domingo project, a crucial step towards a final investment decision. Looking ahead to the next 12 months,

we anticipate further key development milestones across our portfolio that will derisk Ecora’s next wave

of growth.”

Financial Highlights:

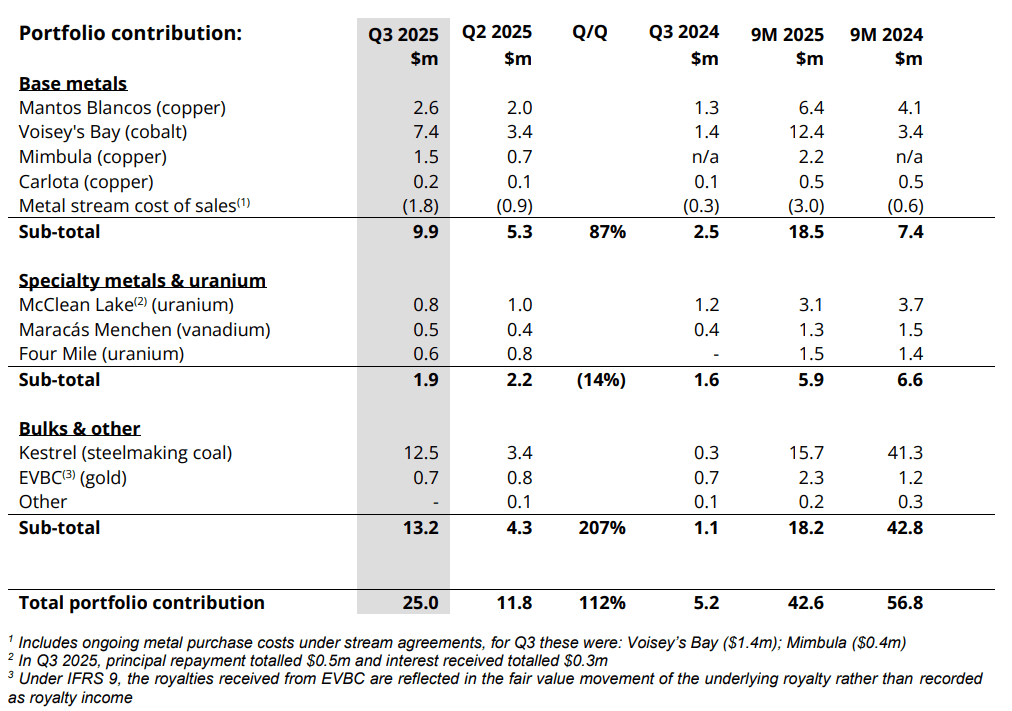

- $25.0 million total portfolio contribution for Q3 2025, up 112% on Q2 2025 ($11.8 million) driven

by continued growth of the base metals portfolio contribution and mining returning to the

Group’s private royalty area at Kestrel throughout the period - Sale of the development stage, non-core Dugbe gold royalty for up to $20.0 million (including an

upfront payment of $16.5 million) with proceeds accelerating a reduction in the Group’s debt - Net debt as at 30 September of $104 million excluding royalty receivables due in October 2025

(30 June 2025: $124.6 million)

Base Metals

- $9.9 million portfolio contribution up 87% on Q2 2025 ($5.3 million) and 296% on Q3 2024 ($2.5

million) - Voisey’s Bay:

o Portfolio contribution increased 122% to $6.0 million (Q2 2025: $2.7 million), with an

average realised price of $18.13/lb (Q2 2025: $18.61/lb)

o 182 tonnes of cobalt received, a 117% increase on Q2 2025 (84 tonnes)

o Democratic Republic of Congo government announced that the cobalt export ban would

expire on 15 October 2025, when it was replaced with a quota system limiting exports to

around 40% of 2024 production (as estimated by the Cobalt Institute)

o FY 2025 guidance increased to 434-448t of attributable cobalt (previously 365-390t)

o FY 2026 guidance is for 500-560t of attributable cobalt with the mine expected to reach

steady state production - Mimbula:

o Portfolio contribution up 120% to $1.1 million (Q2 2025: $0.5 million) driven by the 150

tonnes of attributable production in Q2 2025

o Copper entitlement for Q3 2025 of 175 tonnes generating Q4 2025 portfolio contribution

of $1.3 million - Mantos Blancos:

o Quarterly record portfolio contribution of $2.6 million (Q2 2025: $2.0 million) - Santo Domingo:

o Post period end, Capstone Copper announced that it had entered into a binding

agreement with entities managed by Orion Resource Partners LP to sell 25% interest in

the Santo Domingo project, which clears the path to a Final Investment Decision to

proceed with construction of the Santo Domingo project in H2 2026

Specialty Metals and Uranium

- Specialty metals and uranium portfolio generated $1.9 million of portfolio contribution in Q3

2025 (Q2 2025: $2.2 million) - Rainbow Rare Earths has continued to make strong progress on the Phalaborwa project and

announced test results that:

o Confirm an exceptionally pure mixed rare earth product

o Achieve successful incorporation of a cerium depletion step, which simplifies the process

and is expected to reduce capital and operating costs

Bulks and Other

- Bulks and other portfolio generated $13.2 million (Q2 2025: $4.3 million):

- Kestrel:

o Mining was in the Group’s private royalty area throughout the quarter and generated a

portfolio contribution of $12.5 million

o 1.6mt of saleable production from the Group’s private royalty area in Q3 2025 (Q2 2025:

0.4mt)

o FY volume guidance remains unchanged at between 2.2mt and 2.3mt of saleable

production in the Group’s private royalty area

Quarterly Financial Summary

About Ecora Resources

Ecora is a leading critical minerals focused royalty company. Our vision is to be globally recognised as the royalty company of choice synonymous with commodities that support trends of electrification by continuing to grow and diversify our royalty portfolio in line with our strategy. We will achieve this through building a diversified portfolio of scale over high quality assets that drives low volatility earnings growth and shareholder returns.

The mining sector has an essential role to play in the energy transition, with commodities such as copper,

nickel and cobalt – key materials for manufacturing batteries and electric vehicles. Copper also plays a critical role in our electricity grids. All these commodities are mined and there are not enough mines in operation today to supply the volume required to achieve the energy transition.

Our strategy is to acquire royalties and streams over low-cost operations and projects with strong management teams, in well-established mining jurisdictions. Our portfolio has been reweighted to provide material exposure to this commodity basket and we have successfully transitioned from a coal orientated royalty business in 2014 to one that by 2026 will be materially coal free and comprised of over 90% exposure to commodities that support a sustainable future. The fundamental demand outlook for these commodities over the next decade is very strong, which should significantly increase the value of our royalty portfolio.

Ecora’s shares are listed on the London and Toronto Stock Exchanges (ECOR) and trade on the OTCQX

Best Market (OTCQX: ECRAF).

Ecora Resources is a market awareness client of Capital 10X. For more information, including potential conflicts of interest please see our Content Disclaimer.