Disseminated on Behalf of Amerigo Resources

Q3-2025 Net Income of $6.7 million, EBITDA1 of $18.7 million and Free Cash Flow to Equity1 of

$11.1 million

- Full Debt Repayment Achieved in October 2025

- Quarterly dividend Increased by 33%

- Quarterly Dividend of Cdn$0.04 Declared

Amerigo Resources Ltd. (TSX: ARG; OTCQX: ARREF) announced a strong financial performance for the three months

ended September 30, 2025 (“Q3-2025”) and the full repayment of corporate debt on October 27, 2025. Dollar

amounts in this news release are in U.S. dollars unless indicated otherwise.

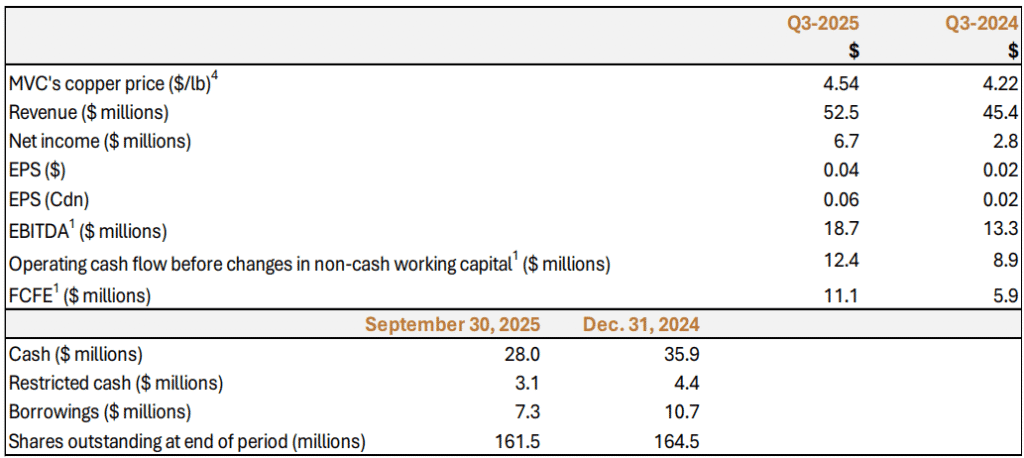

Amerigo’s Q3-2025 financial results included net income of $6.7 million, earnings per share (“EPS”) of $0.04,

EBITDA1of $18.7 million, operating cash flow before changes in non-cash working capital1 of $12.4 million and

free cash flow to equity (“FCFE”) of $11.1 million. In Q3-2025, Amerigo returned $3.5 million to shareholders

through its quarterly dividend of Cdn$0.03 per share.

test

“We are pleased to report strong financial results for the third quarter of 2025. Our operation, Minera Valle

Central (“MVC”), experienced lower than expected production during the quarter, as reported in prior news

releases. However, the Company delivered solid cost and financial performance in a rising copper price

environment. This strong performance positioned MVC to fully repay its remaining debt of $7.5 million on

October 27, 2025,” said Aurora Davidson, Amerigo’s President and CEO.

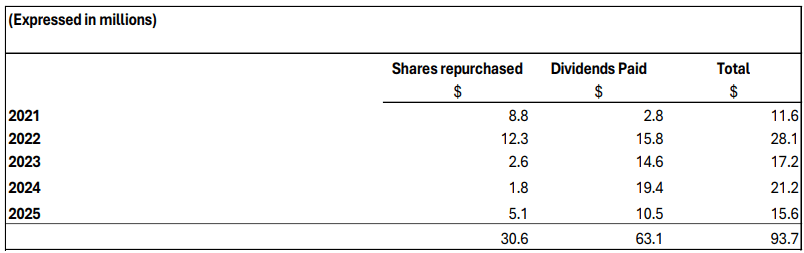

“Reaching debt-free status was one of our stated objectives for 2025 and concludes a strategic ten-year period

for the Company. In 2015, the first debt tranche of $64.4 million was secured to fund MVC’s expansion without

diluting shareholders, followed by a $35.3 million tranche in 2017 to fund the second expansion phase. This

debt was restructured in 2021, allowing Amerigo to quickly deploy its Capital Return Strategy, which has

returned $93.7 million to shareholders to date. The Company’s quarterly dividend has now been increased to

Cdn$0.04 per share, which is roughly 50% of the annual additional free cash flow that will become available

from not carrying debt.”

“Recent copper supply disruptions have further strengthened copper demand fundamentals. This strength has

driven a significant price increase from September’s average LME copper price of $4.51 per pound to $4.83 per

pound in October, as of this news release. In this setting, Amerigo continues to provide an unmatched way to

invest in copper, backed by the Company’s ability to deliver predictable results and a consistent return of

capital to shareholders,” Ms. Davidson added.

Free cashflow to equity is a non-IFRS measure. See “Non-IFRS Measures” for further information.

On October 27, 2025, Amerigo’s Board of Directors declared its seventeenth consecutive quarterly dividend.

The dividend will be in the amount of Cdn$0.04 per share, payable on December 19, 2025, to shareholders of

record as of November 28, 20253

Amerigo designates the entire amount of this taxable dividend to be an

“eligible dividend” for purposes of the Income Tax Act (Canada), as amended from time to time.

Based on Amerigo’s September 30, 2025, share closing price of Cdn$2.72, the Cdn$0.04 quarterly dividend

declared on October 27, 2025, represents an annual dividend yield of 5.88%.

This news release should be read with Amerigo’s interim consolidated financial statements and

Management’s Discussion and Analysis (“MD&A”) for Q3-2025, available on the Company’s website at

www.amerigoresources.com and on the SEDAR+ website at www.sedarplus.ca.

Quarterly Financial Review

Highlights and Significant Items

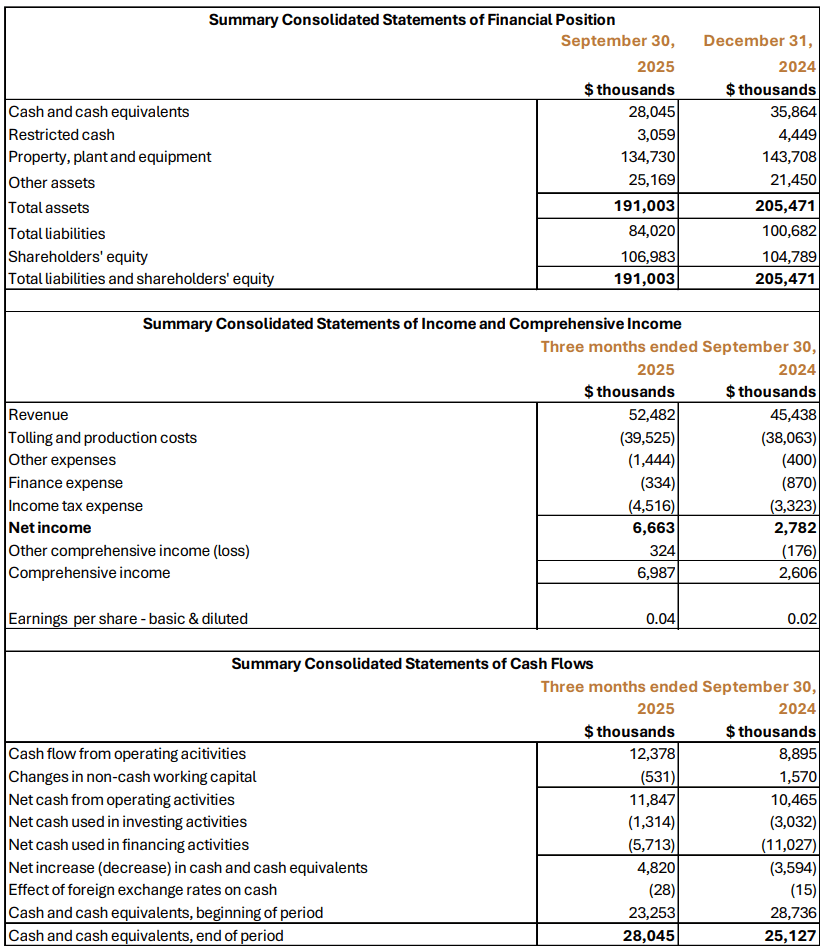

- In Q3-2025, Amerigo’s posted net income of $6.7 million (Q3-2024: $2.8 million), driven by copper

production from MVC of 14.6 million pounds (“M lbs”) (Q3-2024: 16.3 M lbs) at an average MVC copper

price of $4.54 per pound (“/lb”) (Q3-2024: $4.22/lb). In Q3-2025, net income was higher as a result of $1.3

million in positive fair value adjustments to copper revenue receivables from a quarter-on-quarter copper

price appreciation (Q3-2024: $2.7 million in negative fair value adjustments), as well as a decrease in

smelting and refining charges of $3.0 million from $6.4 million in Q3-2024 to $3.4 million in Q3-2025. - EPS in Q3-2025 was $0.04 (Cdn$0.06), compared to $0.02 (Cdn$0.02) in Q3-2024.

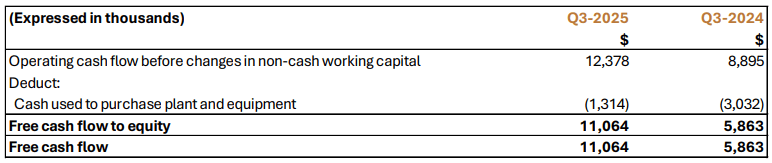

- The Company generated operating cash flow before changes in non-cash working capital1 of $12.4 million

in Q3-2025, compared to $8.9 million in Q3-2024. The Company’s quarterly net operating cash flow was

$11.8 million (Q3-2024: $10.5 million) after changes in working capital in the period. - Free cash flow to equity1 was $11.1 million in Q3-2025 (Q3-2024: $5.9 million), after capital expenditures

payments of $1.3 million (Q3-2024: $3.0 million).

1 This is a non-IFRS measure. See “Non-IFRS Measures” for further information.

3 - In Q3-2025, Amerigo returned $3.5 million to shareholders (Q3-2024: $8.5 million) through Amerigo’s

regular quarterly dividend of Cdn$0.03 per share (Q3-2024: through the payment of Amerigo’s quarterly

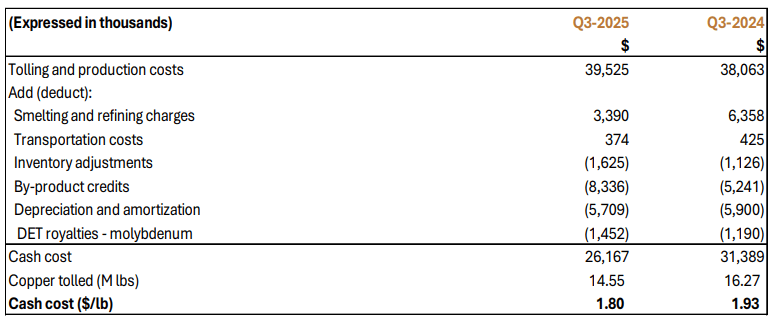

dividend of Cdn$0.03 per share as well as a performance dividend of Cdn$0.04 per share). - Q3-2025 cash cost1 was $1.80/lb (Q3-2024: $1.93/lb). The $0.13/lb reduction in cash cost1 was caused

predominantly by a $0.25/lb increase in molybdenum by-product credits from stronger molybdenum prices

and a $0.16/lb decrease in smelting and refining charges in response to the current annual benchmark,

offset by a $0.07/lb increase in power cost, a $0.07/lb increase in lime costs, a $0.04/lb increase in

maintenance, and a $0.03/lb increase in other direct costs. - On September 30, 2025, the Company held cash and cash equivalents of $28.0 million (December 31,

2024: $35.9 million), restricted cash of $3.1 million (December 31, 2024: $4.4 million), and had working

capital (current assets less current liabilities) of $0.9 million, up from a working capital deficiency of $6.5

million on December 31, 2024. - On September 30, 2025, the provisional copper price used by MVC was $4.54/lb. The final prices for July,

August, and September 2025 sales will be the average London Metal Exchange (“LME”) prices for October,

November, and December 2025, respectively. A 10% increase or decrease from the $4.54/lb provisional

price used on September 30, 2025, would result in a $6.8 million change in revenue in Q4-2025 regarding

Q3-2025 production.

Investor Conference Call on October 30, 2025

Amerigo’s quarterly investor conference call will occur on Thursday, October 30, 2025, at 11:00 a.m. Pacific

Daylight Time/2:00 p.m. Eastern Daylight Time. Participants can join by visiting

https://emportal.ink/4hqveMG and entering their name and phone number. The conference system will then

call the participants and place them instantly into the call. Alternatively, participants can dial directly to be

entered into the call by an Operator. Dial 1-888-510-2154 (Toll-Free North America) and state they wish to

participate in the Amerigo Resources Q3-2025 Earnings Call.

Non-IFRS Measures

This news release includes five non-IFRS measures: (i) EBITDA, (ii) operating cash flow before changes in non-cash working capital, (iii) free cash flow to equity (“FCFE”), (iv) free cash flow (“FCF”) and (v) cash cost.

These non-IFRS performance measures are included in this news release because they provide key performance measures used by management to monitor operating performance, assess corporate performance, and plan and assess the overall effectiveness and efficiency of Amerigo’s operations. These performance measures are not standardized financial measures under International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”), and, therefore, amounts presented may not be comparable to similar financial measures disclosed by other companies. These performance measures should not be considered in isolation as a substitute for performance measures in accordance with IFRS Accounting Standards.

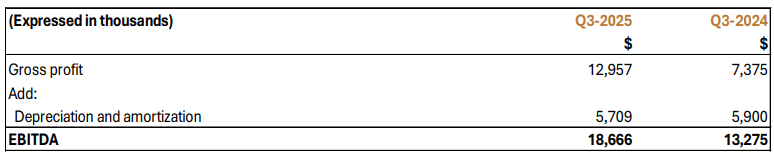

(i) EBITDA refers to earnings before interest, taxes, depreciation, and administration and is calculated by adding depreciation expense to the Company’s gross profit.

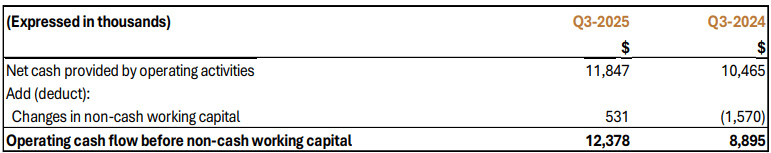

(ii) Operating cash flow before changes in non-cash working capital is calculated by adding back the decrease or subtracting the increase in changes in non-cash working capital to or from cash provided by operating activities.

(iii) Free cash flow to equity (“FCFE”) refers to operating cash flow before changes in non-cash working capital, less capital

expenditures, plus new debt issued less debt repayments. FCFE represents the amount of cash generated by the Company

in a reporting period that can be used to pay for the following:

a) potential distributions to the Company’s shareholders and

b) any additional taxes triggered by the repatriation of funds from Chile to Canada to fund these distributions.

Free cash flow (“FCF”) refers to FCFE plus repayments of borrowings.

(iv) Cash cost is a performance measure commonly used in the mining industry that is not defined under IFRS. Cash cost is the aggregate of smelting and refining charges, tolling/production costs net of inventory adjustments and administration costs, net of by-product credits. Cash cost per pound produced is calculated by dividing the cash cost by the number of pounds of

copper produced.

2 Capital returned to shareholders

The table below summarizes the capital returned to shareholders since the implementation of Amerigo’s Capital Return

Strategy in October 2021.

Dividend dates

A dividend of Cdn$0.04 per share will be paid on December 19, 2025, to shareholders of record as of November 28, 2025. Under the “T+1 settlement cycle”, the Company’s shares will commence trading ex-dividend at the opening of trading on November 28, Shareholders purchasing Amerigo shares on or after the ex-dividend date will not receive this dividend, as it will be paid to the selling shareholders. Shareholders purchasing Amerigo shares before the ex-dividend date will receive the dividend.

MVC’s copper price

MVC’s copper price is the average notional copper price for the period before smelting and refining, DET notional copper

royalties, transportation costs and excluding settlement adjustments to prior period sales. MVC’s pricing terms are based on the average LME copper price of the third month following the delivery of copper concentrates produced under the DET tolling agreement (“M+3”). This means that when final copper prices are not yet known, they are

provisionally marked to market at the end of each month based on the progression of the LME-published average monthly M and M+3 prices. Provisional prices are adjusted monthly using this consistent methodology until they are settled.

Q2-2025 copper deliveries were marked to market on June 30, 2025, at an average price of $4.42/lb and were settled in Q3-2025

as follows:

- April 2025 sales settled at the July 2025 LME average price of $4.44/lb

- May 2025 sales settled at the August 2025 LME average price of $4.38/lb

- June 2025 sales settled at the September 2025 LME average price of $4.51//lb

Q3-2025 copper deliveries were marked to market on September 30, 2025, at an average price of $4.54/lb and will be settled at

the LME average prices for October, November, and December 2025.